The CSR Limited (ASX: CSR) share price is limping lower following the release of its first-half results.

At the time of writing, shares in the materials manufacturer are down 1.2% to $5.55. Surprisingly, the share price rallied in the first moments of trading, reaching $5.98 before reversing into a nosedive.

Let's take a closer look at what was reported.

Energy costs cut into earnings

The latest first-half result from CSR is a mixed bag for investors to digest. Upfront, the headline figures posted by the owner of Gyprock, Bradford, and Himmel brands include:

- Group revenue up 5% year on year to $1.4 billion

- Group earnings before interest and tax (EBIT) down 27% to $126 million

- Statutory net profit after tax (NPAT) down 11.5% to $92 million

- Interim fully franked dividend of 15 cents per share, down from 16.5 cents per share

CSR operates across three segments: building products, property, and aluminium. Based on the half-year figures, it appears building products performed solidly during the period.

The segment responsible for various interior systems, masonry and insulation, and construction systems achieved a record EBIT of $165 million — increasing 18% on the prior corresponding period. Notably, the smallest part of this division (construction systems) recorded the highest increase in revenue at 17%.

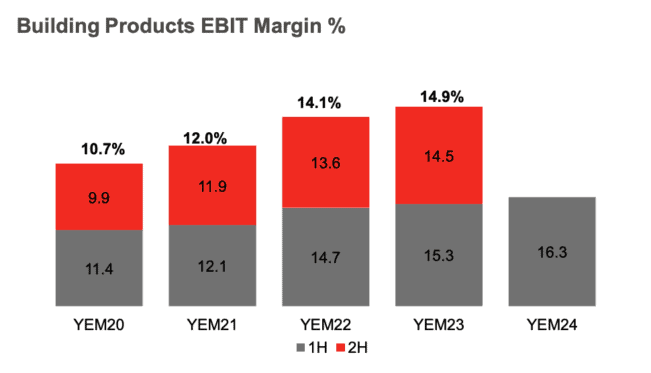

According to the release, the robust performance in building products was driven by price increases and volume growth across Gyprock, Hebel and Bradford offerings. Pleasingly, the top-line growth was accompanied by continued improvement in EBIT margins, as shown below.

In contrast, the picture wasn't as pleasant for CSR's property and aluminium arms, potentially weighing on the CSR share price today. Both segments delivered negative EBIT in the half — property recording negative $1.5 million and negative $24 million for aluminium.

The substantial negative earnings under the aluminium smelter roof were attributed to "elevated material costs and increased energy production costs".

Expert thoughts as CSR share price slips

A couple of analysts have already chimed in on the CSR result today. The analysts at UBS and Citi shared varying views on the report.

Firstly, Citi analyst Samuel Seow provided some insight into CSR's EBIT not living up to expectations. According to Seow, once you allow for a "timing issue" in the property segment, the before-tax earnings appear roughly in line.

Meanwhile, UBS analyst Lee Power took it a step further, stating:

We think the result should be seen as a small beat even including an Aluminium miss.

UBS currently holds a target of $6.50 on the CSR share price. Whereas Citi has a much more conservative $5.45 goalpost.

What's the outlook?

CSR provided some light on what investors can expect for FY2024 in its release today.

Notably, $44 million in contracted earnings will be included under the property segment. This will flow from the next tranche at Horsley Park, New South Wales. Conversely, the company is pencilling in a possible $15 million to $30 million EBIT loss for its aluminium business for the 12-month period.

No financial figures were provided for the building products segment. However, the pipeline of detached housing under construction remains roughly 50% above historical averages.

The CSR share price is up 19.3% over the past year.