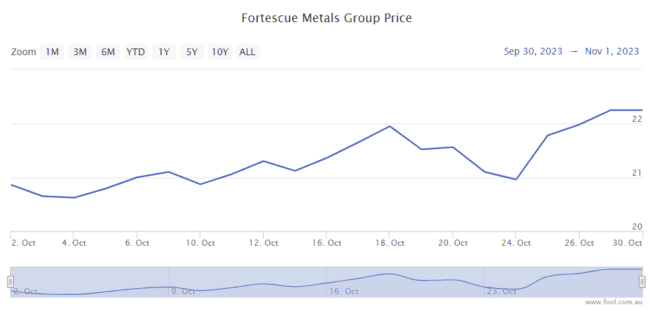

The Fortescue Metals Group Ltd (ASX: FMG) share price went up 8% in October, as we can see on the chart below. In this article, I'm going to look at the outlook for Fortescue shares in November and beyond.

As one of the largest ASX iron ore shares, the business' success is closely tied to the iron ore price.

So, let's have a look at what could happen with the iron ore price, which may be influential for the Fortescue share price.

Broker predicts strong iron ore price

According to reporting by The Australian, the iron ore price is expected by the broker Citi to be US$120 per tonne over the next three months, which is close to where it is now.

If things go positively for the commodity, then Citi thinks the iron ore price could reach as high as US$130 per tonne. Citi wrote:

China's surprising policy efforts last week, coupled with fresh supply risk from an industry strike in Western Australia, have led to iron ore rallying recently.

These measures haven't completely turned the overall market sentiment, but we remain cautious (positive) about potential incremental supports and Beijing's intention to engineer a strong start to 2024.

We believe iron ore is still the one most exposed (positively) to further policy support compared to other commodities.

While the Chinese construction sector is struggling, there seem to be other parts of the economy picking up some of the slack, such as steel exports, (electric) vehicle manufacturing and renewable energy infrastructure.

Fortescue Metals CEO Dino Otranto recently said to the ABC in an interview that the business is confident on the long-term for China and also that decarbonisation is going to take a lot of steel.

Projections relevant to Fortescue shares

The commodity price is just part of the picture for an ASX mining share. How much it's able to produce can also have an impact on revenue and profit generation.

In the first quarter of FY24, Fortescue said that its total ore shipments were down 3% to 45.9 million tonnes. In FY24, it's expecting iron ore shipments of between 192mt to 197mt, including approximately 5mt from the new high-quality project Iron Bridge.

The business continues to invest in its green energy initiatives and expects to spend US$400 million on capital expenditure and investments, excluding projects that are subject to a final investment decision.

With higher iron ore prices, the company is projected to generate another strong year of earnings and dividends.

On Commsec, the business is projected to generate $2.58 of earnings per share (EPS) and pay an annual dividend per share of $1.41 in FY24. That implies the Fortescue share price is trading at a forward price/earnings (P/E) ratio of less than 9 and could pay a grossed-up dividend yield of 8.9%.