The Mesoblast Ltd (ASX: MSB) share price was singed on Tuesday as investors reacted to the company's quarterly cash flow report.

While the S&P/ASX 200 Index (ASX: XJO) wobbled around before settling flat for the day, shares in the regenerative medicine company retreated. A sign of the disappointment, Mesoblast shares slipped 2.7% to 35 cents apiece — within 1 cent of its 52-week low.

Let's take a look at what shareholders were faced with today.

The clock is ticking

For the three months ended 30 September 2023, Mesoblast continued to work on getting approval for Remestemcel-L to treat steroid-refractory acute graft versus host disease (SR-aGVHD). However, the process of conducting phase 3 trials and ongoing research continues to consume more money than the business is generating.

Mesoblast started the quarter with $71.32 million of cash in the bank. Notching up a $14.24 million cash outflow from operations, along with some investing and financing expenses, the company was left with $53.18 million worth of cash at the end of the quarter.

According to the report, cash preservation initiatives are underway to ensure the well doesn't run dry before Ryoncil makes it to market. The company has reduced net operating cash usage over the past two years by 37%, with the intention of delivering a further 23% reduction.

Simultaneously, Mesoblast says it is looking at other monetisation opportunities to increase revenue. As it stands, royalties from its TEMCELL HS Inj produced US$1.6 million worth of revenue in the quarter. The figure represents a 24% increase compared to the prior corresponding period.

Commenting on the progress achieved in the quarter, Mesoblast CEO Silviu Itescu said:

During the period we had a very productive meeting with the United States Food and Drug Administration (FDA), which has allowed us to establish the path forward for potential pediatric and adult approvalsof Ryoncil®(remestemcel-L)in steroid-refractory acute graft versus host disease (SR-aGVHD).

Adding:

I am very confident that the cost reduction strategies we have implemented, together with operational streamlining and access to additional sources of capital, will facilitate the balance sheet strength needed to complete our Phase 3 programs for adults with SR-aGVHD and for chronic inflammatory low back pain through to product approvals and commercialization.

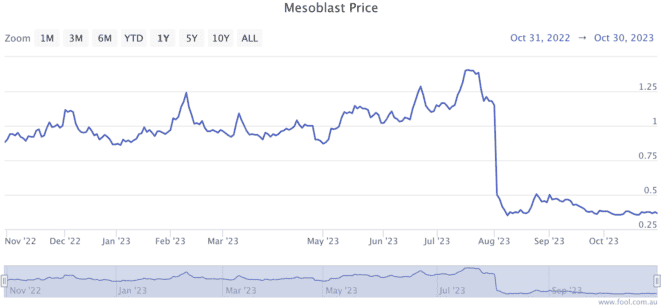

The Mesoblast share price fell off a cliff on 4 August when it failed to get the green light from the FDA after its initial submission. As shown above, the company's shares sank from $1.09 to 47 cents after returning from a trading halt.

Shorters are targeting the Mesoblast share price

Mesoblast joined a number of ASX lithium shares yesterday in the most shorted list this week.

Attracting a short interest of 8%, the cash-strapped company ranked as the tenth most shorted ASX-listed company. It would seem short sellers are betting on Mesoblast facing some more hurdles still ahead.

The Mesoblast share price is down 62% over the past 12 months.