IPH Ltd (ASX: IPH) is an S&P/ASX 200 Index (ASX: XJO) share that fund manager Contact Asset Management really likes.

It's probably not a well-known business to some readers – it's described as a leading intellectual property services outfit, which specialises in patents and trademarks.

The ASX 200 share operates in more than 10 IP jurisdictions and employs more than 1,300 people. Around half of its earnings are generated in Australia, 28% in Asia and 22% in Canada.

Why the IPH share price looks cheap

The fund manager has been surprised by the "relative softness" of the IPH share price in recent months. Contact likes that the legal business has a defensive business model and solid growth outlook, which are "characteristics that would normally be eagerly sought after by investors."

According to Contact, IPH is trading at a discount of almost 20% to its average price/earnings (P/E) ratio since listing. It pointed out that the ASX 200 share is a beneficiary of a weaker Australian dollar, though the historical correlation to the IPH share price has "recently broken down".

IPH doesn't hedge its foreign exchange and estimates that for every 1 cent move in the exchange rate equates to A$1.9 million in revenue.

Contact said that it's not expecting explosive growth for the business, and it's prepared to wait for the earnings to compound while it receives a healthy dividend yield.

The fund manager described IPH as having a "quality, long-term, recurring revenue model" which is "beautiful" in the eyes of Contact.

IPH's CEO Andrew Blattman is rated by Contact, he has been with the business since 1995 and overseen transformation of the company into "category leadership through the implementation and execution of organic and acquisition strategies."

Under Blattman's leadership, earnings per share (EPS) has compounded at 16% per annum. IPH has a dividend payout policy of 80% to 90% of earnings, and it has grown its annual dividend per share every year since listing.

According to Contact, the IPH dividend is predicted to grow 9% in FY24 to 36 cents per share, which would be a partially franked dividend yield of 5.15%.

Why is IP a good industry and what about the future of the ASX 200 share?

The fund manager explained that IP was "often fundamental to the operations and value of many of the world's leading companies" and they needed to ensure their investment was protected. Contact explained that IPH played "a pivotal role in ensuring that client IP is suitably protected".

The ASX share may be able to grow its margins in the future thanks to artificial intelligence. Contact explained:

In its FY23 result presentation, IPH noted that "AI will shape the future of the IP profession". There is much work to be done on assessing the first and second order effects of this nascent technology, as currently complexity remains around human and AI collaboration and the ability to patent.

Generative AI will contribute to efficiencies in the administration of IP by streamlining the patent process and maximising productivity. This includes reducing friction in the patent process itself, from assisting in preparing patent specifications to automating infringement searches.

In all, we believe that any technological advancement in AI leads to margin expansion for IPH.

IPH share price snapshot

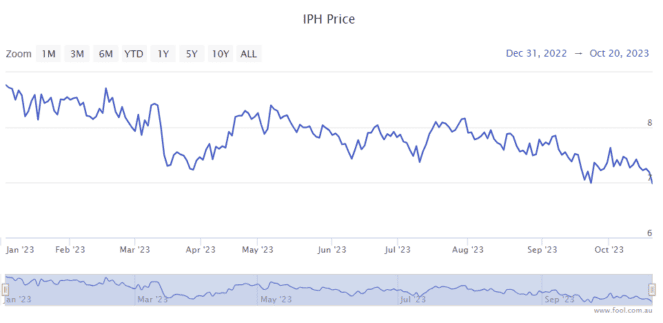

Since the start of 2023, the IPH share price has fallen close to 20%, as we can see on the chart below.