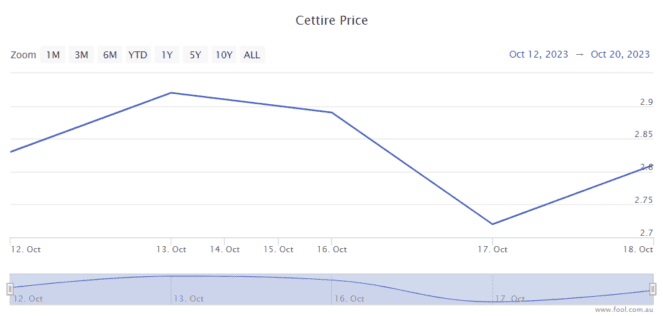

The Cettire Ltd (ASX: CTT) share price has suffered in the last week, it's down by 19%, as we can see on the chart below. It could be time to look at the All Ordinaries (ASX: XAO) share.

For readers who haven't heard of this business, it's an online retailer of over 500,000 luxury goods from over 2,500 luxury brands.

I don't think an ASX All Ords share is a buy just because it has fallen, the valuation has to make sense. For me, the Cettire share price is much more attractive because of at least three reasons.

Strong revenue growth

One of the most important elements of a company's long-term success is the level of organic revenue growth. If a business is only growing revenue by 3% per year, it's hard to imagine that profit will rise much faster than that, so the share price growth may not do much better. Of course, dividends and share buybacks can juice returns.

Cettire is growing sales rapidly. In the first three months of FY24 sales revenue increased 92% year over year.

It also saw revenue growth of 80% year over year (pre-accounting adjustments of deferred revenue and refund provisioning) in October, up to the 17th.

It wouldn't be wise to think the ASX All Ords share's revenue will keep climbing 80% per annum forever, but that level of growth can quickly compound into a very large number after two or three years.

Seeing as Cettire is targeting a wealthier level of customer, it may continue to see good demand during any downturn because richer customers still have money to spend. That may be why we're still seeing such strong growth from the business despite the elevated inflation and interest rates.

Making profit

Some ASX growth shares are scaling up rapidly, but still at a stage where they're making losses.

In FY23, the company made statutory net profit after tax (NPAT) of $16 million and adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) of $29.3 million.

Profitability seems to have continued – it made adjusted EBITDA of $8.7 million in the first quarter of FY24, compared to "at least $3 million" in the first quarter of FY23, implying growth of roughly 190%.

With an online digital model, the company's profit margins can keep rising. Profit could grow faster than revenue (which is rapidly growing itself).

Customers coming back

A sign that an ASX All Ords share's offering is worthwhile is whether customers come back. A company may not need to spend (as much) on marketing to win a returning customer because they already have their attention and contact details. More returning customers can help with the ASX All Ords share's margins.

Cettire reported that in the first quarter of FY24, total active customers increased 69% to 487,289. More importantly in my view, the percentage of gross revenue from repeat customers increased from 56% last year to 59% this year. That's a great sign that customers are coming back and could keep coming back for more.

Foolish takeaway

With Cettire now a lot cheaper, it could be an opportunity to buy the dip as it keeps growing. However, its share price seems very volatile, so it could fall more from here, but that could make it even better value.