The Santos Ltd (ASX: STO) share price was up 0.5% in early trade before giving back those gains, and then some.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock closed yesterday trading for $7.85. At the time of writing on late Thursday morning, shares are swapping hands for $7.845, down 0.06%.

Still, that handily outperforms the 1.38% loss posted by the ASX 200 at this same time.

This relative outperformance comes following the release of Santos' quarterly update for the three months ending 30 September (Q3 2023).

What's aiding the Santos share price today?

The Santos share price is outperforming the broader market losses today after the company reported it achieved US$1.4 billion of sales revenue over the three months. That's up from US$1.3 billion in the prior quarter. However, it comes in well below the US$2.2 billion in sales revenue achieved in Q3 2022 amid higher oil and gas prices at that time.

Third quarter production came in at 23.3 million barrels of oil equivalent (mmboe). This was an improvement on Q2, largely thanks to increased crude oil production in PNG.

Santos said Bayu-Undan is continuing to produce. The company expects at least one more LNG cargo from the site, followed by sales into the Australian domestic market until the end of its field life.

The ASX 200 energy company achieved free cash flow from operations of some US$470 million for the three months. Year to date, free cash flow comes in at US$1.6 billion.

The company said its strong balance sheet will enable it to deliver on its sizeable pipeline of development projects.

What did management say?

Commenting on the results that are helping the Santos share price outperform today, CEO Kevin Gallagher said:

Free cash flow of US$1.6 billion year-to-date positions the company well to deliver shareholder returns, backfill and sustain our existing business, while also investing in our major projects and progressing our decarbonisation plans.

As for those decarbonisation plans, Gallagher added:

The Santos Energy Solutions business is advancing with the Moomba CCS project, it is now 75% complete and on track for start-up in mid-2024. This project will be the only CCS project in Australia that has currently qualified to generate Australian Carbon Credit Units for CO2 injected and stored in Cooper Basin reservoirs.

Direct Air Capture field trials at Moomba will also begin this year, with the unit having arrived onsite in September.

What's next?

Looking to what could impact the Santos share price in the months ahead, the company maintained its prior 2023 production guidance.

That includes total production of 89 to 93 mmboe with sales volumes of 90 to 100 mmboe.

On the capex front, Santos expects to spend up to $1.6 billion on its major projects, which includes its Santos Energy Solutions segment.

Santos share price snapshot

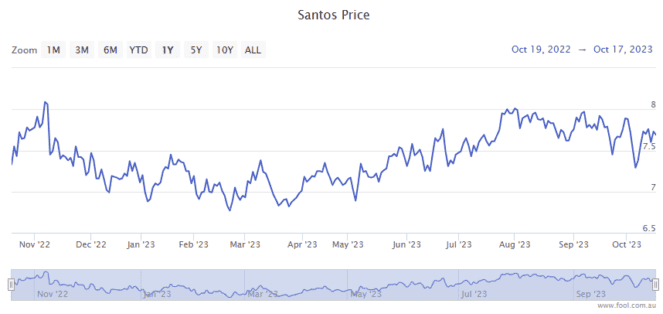

Santos shares have gained 10% so far in 2023.