Rio Tinto Ltd (ASX: RIO) shares closed down 1.65% to $115.47 apiece on Thursday amid news of a planned production upgrade already at its newest mine.

The Gudai-Darri iron ore mine in the West Australian Pilbara only began production last year.

Rio Tinto describes Gudai-Darri as its "most technologically advanced" operation.

The mine reached its planned annual capacity of 43 million tonnes of iron ore in less than 12 months.

Now, Rio Tinto reckons it can raise production to 50 million tonnes a year through incremental efficiency enhancements.

The ASX 200 miner outlined its plans in a press release issued this week.

Let's dig into the details.

'A low-capital pathway' to greater production

Rio Tinto thinks it will cost about US$70 million to make a number of changes at Gudai-Darri, including bringing in more haul trucks and diggers, and undertaking a small expansion of its product stockyards.

Matthew Holcz, Rio Tinto's iron ore managing director of Pilbara mines, commented:

What we have learnt during the rapid ramp-up of Gudai-Darri has given us the confidence to find better ways to increase capacity …

Rather than taking a capital-intensive approach to replicate existing infrastructure, we have now identified a low-capital pathway to creep capacity to 50 million tonnes a year.

The plans are subject to various environmental, heritage and other relevant approvals.

It's even got its own solar farm

Some of the high-tech elements of Rio Tinto's Gudai-Darri operations include autonomous trains, trucks, and drills, the world's first autonomous water carts, and a robotic ore sampling laboratory.

The site also houses a solar farm comprising about 83,000 solar panels that can generate up to 34MW of electricity.

The farm is expected to supply about a third of the mine's average electricity use once fully commissioned.

According to The Age, Rio Tinto is considering using some of its closed mining sites to build more solar farms to help it offset the three million tonnes of carbon emissions that its 17 mines generate each year.

Rio Tinto is also considering using wind power and is monitoring wind speeds at various locations.

Recent history of Rio Tinto shares

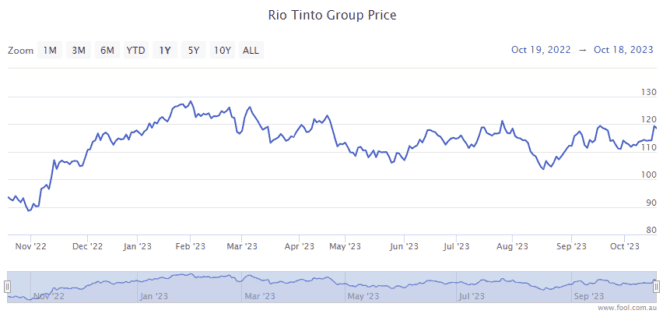

The Rio Tinto share price has risen 23% over the past 12 months despite a 30% decline in the iron ore price.