The S&P/ASX 200 Index (ASX: XJO) is making its way higher today, encouraged by a robust session on Wall Street last night. One ASX 200 share running at the front of the positive pack earlier today was Hub24 Ltd (ASX: HUB), amid the company's first quarter update to investors.

To set the scene, shares in the wealth management platform provider eclipsed its previous 52-week high in the first 30 minutes of trade. The Hub24 share price reached $35.51, establishing a newly minted high 5.6% above the previous closing price.

However, enthusiasm toward the ASX 200 share has since settled, with it now trading at $33.75 apiece.

Off and running in FY24

The last few months have given Hub24 shareholders plenty to be pleased about. Ahead of today's update, the share price had already rallied 38.5% from a trough in July. A stretch of strength underpinned by surging funds under administration, revenue, and profits.

Today, the good times keep on rolling as Hub24 posts sustained growth in the first quarter of FY2024.

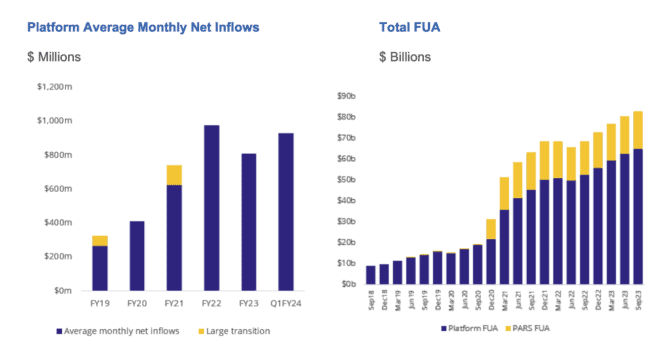

As per the update, the September ending quarter saw total funds under administration (FUA) reach $82.7 billion, depicted below. The figure represents a 24.3% increase on the prior corresponding period. Most notably, this is a re-acceleration in FUA growth, with the prior year's growth a more modest 8.2%.

The biggest contributor to this leap in funds came from the company's 'Platform FUA', rising 24.3%. Meanwhile, the 'Portfolio, Administration and Reporting Services (PARS)' segment notched up a 10.3% increase on the prior corresponding period.

Perhaps less rosy was the slowed rate of funds flowing onto Hub24's platform during the quarter. In Q1, platform net inflows tallied up to $2.8 billion, down 6.3% from the prior corresponding period. Though the amount was markedly higher than the previous quarter, jumping 34.7% in comparison.

Furthermore, Hub24 has been chewing away at its competitor's market share. According to the latest data, the company now holds a 6.3% market share, inching up from 5.4%.

Positively, advisers on Hub24's platform grew 10.6% versus a year ago to 4,026.

Is this ASX 200 share getting cheaper?

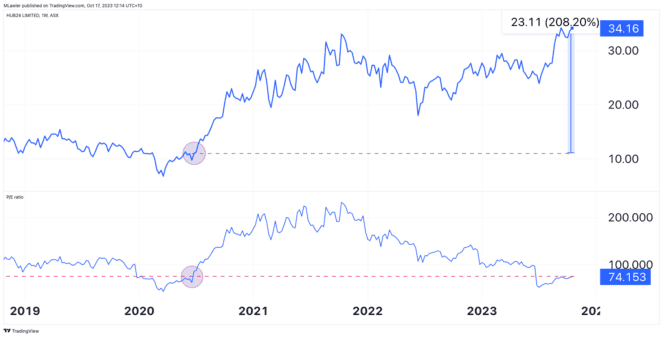

At the time of writing, Hub24 shares trade on a price-to-earnings (P/E) ratio of 74 times. Relatively speaking, this could be considered expensive when compared to others in the same industry. But what about when compared to its past self?

Since July 2020, this ASX 200 share has more than tripled in value. However, its P/E ratio is now mostly unchanged versus three years ago. In the time between, Hub24 shares have been valued at as much as 230 times earnings, as shown below.

Due to the rapid growth in earnings, Hub24's earnings multiple has been able to compress despite the significant share price appreciation.

Yet, a savvy investor would still need to investigate further to determine whether it's worth pulling the trigger on this ASX 200 share.