The Cochlear Limited (ASX: COH) share price is edging higher on Tuesday amid the company's annual general meeting.

In the first hour of trade, shares in the hearing implant device maker are up 0.4% to $256.13. Meanwhile, the broader S&P/ASX 200 Health Care Index (ASX: XHJ) is down slightly, dragged lower by Fisher & Paykel Healthcare Corporation Ltd (ASX: FPH).

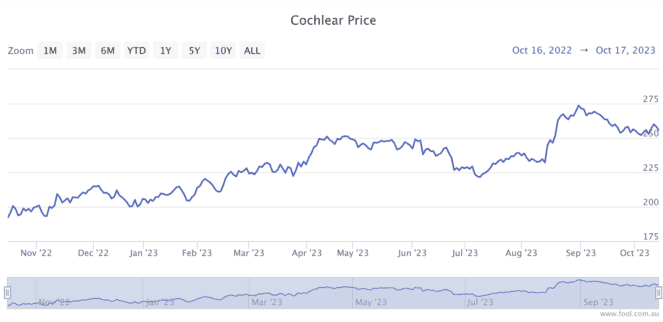

The Cochlear share price is now 34.6% above its 52-week low, enjoying a steady climb up and to the right over the past year, as shown below.

After suffering a temporary slump during the pandemic, Cochlear has come back stronger than ever in many respects. In its full-year results for FY23, the company posted record revenue, rebounded profitability, and a balance sheet without a trace of debt.

Today, Cochlear shareholders get to tune into the annual general meeting (AGM).

What's boosting the Cochlear share price today?

It's that time of the year when shareholders gather around to hear from management and vote on a range of items.

Often, the event can harbour insights into how the business is performing since releasing its latest financial figures. As such, an AGM can be a good pulse check for shareholders to put their minds at ease or to begin asking more questions.

Fortunately for Cochlear shareholders, the information tabled in today's AGM appears positive.

The full release is six pages long, encompassing an address by Cochlear chair Alison Deans and CEO Dig Howitt. However, much adulation is arguably built around the few details supplied on pages four and five.

Noted in Howitt's remarks, Cochlear's previous earnings guidance for FY24 of an increase in underlying net profit of between 16% and 23% still stands. Furthermore, the guidance does not factor in the company's recently cleared acquisition of Denmark-based Oticon Medical's cochlear implant business.

Given the heightened economic and geopolitical uncertainty, the reassurance is a positive for the Cochlear share price today.

Additionally, management expects "solid" market growth rates to enable high single-digit growth (i.e. 5% to 9%) in cochlear implant units during FY24.

Despite the growth in units, the company's market share gains are slated to stabilise from FY23. As it stands, Cochlear lays claim to more than 60% of the global market share in cochlear and acoustic implants.

Lastly, the target dividend payout policy of 70% underlying net profit is being maintained.

Based on the current Cochlear share price, the medical device company offers a dividend yield of approximately 1.3%.