S&P/ASX 200 Index (ASX: XJO) energy stocks have caught the attention of passive income investors amid their soaring dividends over the past two years.

Now those dividend payouts have recently come down some from record levels amid a retrace in energy prices. But leading ASX 200 energy stocks continue to offer investors market-beating, fully franked dividends.

There are a number of quality income stocks on the ASX worth investigating.

For the purposes of this article, I've drilled down to what I believe are two of the best longer-term passive income plays in the energy sector.

The outlook for fossil fuels

As you're surely aware, the world is steering away from fossil fuels in an effort to limit climate change.

But the process of morphing a still growing and developing planet-wide population of more than eight billion people to carbon-neutral energy sources is proving glacial, at best.

That means that for the foreseeable future, the demand for coal, oil and gas is likely to remain robust, offering a solid longer-term outlook for the dividend payments from ASX 200 energy stocks.

On the oil front, the International Energy Agency (IEA) expects global oil demand will increase by 2.2 million barrels per day in 2023, reaching 101.8 million barrels per day. And with OPEC+, led by Saudi Arabia, maintaining its production cuts, Brent crude oil could well top US$100 per barrel this year.

As for coal, nations including Australia have begun shuttering their coal-fired power plants.

However high-quality Australian coking coal remains in strong demand for steel manufacturing.

And some of the world's most populous nations – including China, India, Indonesia and Turkey – continue to construct new coal plants with multi-decade lifespans, ensuring ongoing demand for thermal coal.

With that said, here are two ASX 200 energy stocks I'd buy now for their dividends.

Two high-yielding, high-quality ASX 200 energy stocks

First up we have coal stock New Hope Corp Ltd (ASX: NHC).

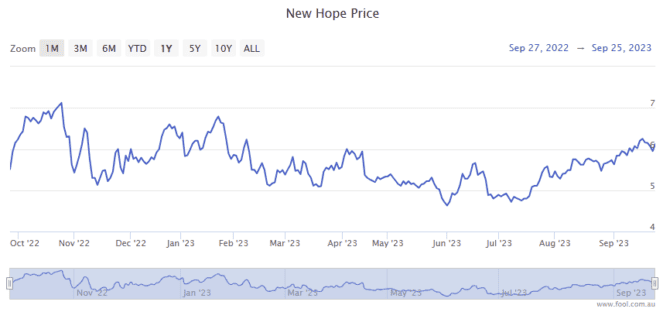

Atop an 8% 12-month share price gain, the ASX 200 energy stock paid an interim dividend of 40 cents per share on 3 May.

The final dividend of 30 cents per share will hit eligible shareholders' bank accounts on 7 November. And it's not too late to bag that passive income. New Hope shares trade ex-dividend on 23 October.

Doing the maths, New Hope delivered (or declared) 70 cents per share in fully franked dividends over the last 12 months.

At the current share price of $6.20 that equates to a juicy yield (part trailing, part pending) of 11.3%.

Which brings us to oil and gas stock Woodside Energy Group Ltd (ASX: WDS).

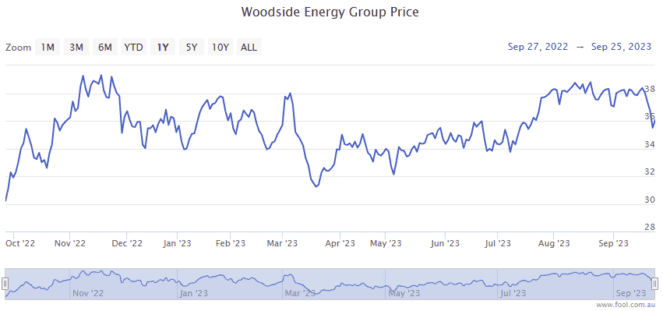

Like New Hope, the Woodside share price has also been a strong performer over the past 12 months, up 16%.

And the ASX 200 energy stock paid out some very appealing, fully franked dividends over that time.

Woodside paid an all-time high final dividend of $2.154 per share on 5 April. The interim dividend of $1.243 per share will be paid out tomorrow, 28 September.

That's a full-year dividend payout of $3.397 per share.

At the current Woodside share price of $35.48, this ASX 200 energy stock trades on a trailing yield of 9.6%.