The Mineral Resources Ltd (ASX: MIN) share price is declining on Tuesday amid its latest announcement.

Heading into the afternoon, shares in mining services company are down 1.9% to $67.08. In saying that, the broader Australian materials sector is feeling a little under the weather today. The red wave follows weakness in the price of iron ore and gold overnight.

However, part of the begrudging stance may stem from plans to dial up the company's debt.

Why more debt?

Investors are selling down Mineral Resources shares after the company revealed its plans to tap the debt market. In an announcement to the ASX this morning, the lithium and iron ore miner said it intends to offer up to US$850 million (A$1.3 billion) worth of senior unsecured notes.

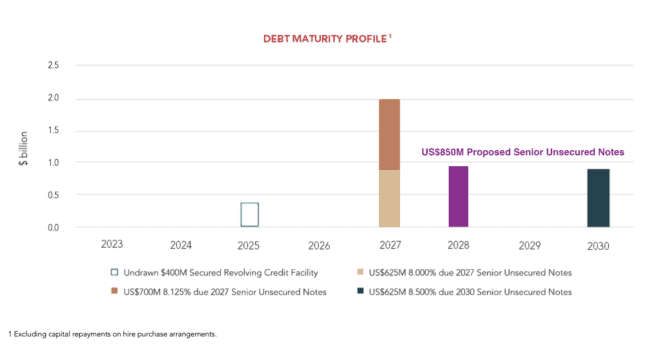

The exact details of the offer were sparse. More details will likely be shared once the company evaluates the appetite of potential note holders. However, we know that the unsecured form of debt will come with a 2028 due date, as labelled in purple in the diagram below.

Mineral Resources held A$2.917 billion of debt on its balance sheet at the end of FY23. Furthermore, it retained a net debt position of A$1.538 billion once cash and cash equivalents were accounted for.

This calculated out to a net debt-to-equity ratio of roughly 44% at the time. For reference, this marked a significant deterioration from the approximately 12% a year prior. Assuming the cash and equity are similar to June, the additional debt could take the company's net debt ratio to 80%.

So, why is Mineral Resources jacking up its debt funding?

According to the release, the cash proceeds from the issuance of notes would be used for "general corporate purposes", including capital expenditures (Capex).

No specifics were given on which sites or projects the funding could be allocated to.

Is the Mineral Resources share price expensive?

Mineral Resources shares currently trade on a price-to-earnings (P/E) ratio of 55. This is relatively expensive compared to the 11 times average of the Australian mining and metals industry. Though, it doesn't necessarily tell the whole story.

Grady Wulff from Bell Direct labelled the mining services company a 'winner' from the latest reporting season. Additionally, Wulff believes the outlook for lithium remains strong.

Furthermore, another broker holds a share price target of $84 on Mineral Resources. This would suggest a possible 25% upside from the current price.