It's been a rough start to the trading week for the All Ordinaries Index (ASX: XAO) and most ASX shares this Monday. At the time of writing, the All Ords has fallen 0.16% so far during today's trading. So those interested in the Australian Vanadium Ltd (ASX: AVL) share price might be happy to hear that their company is spending today on the sidelines.

Yep, this morning, Australian Vanadium told investors that its shares would be spending the day in a trading halt. The purpose of this trading halt? Australian Vanadium is set to merge with another ASX vanadium share.

The company confirmed to investors this morning that Australian Vanadium has agreed to a $217 million merger with Technology Metals Australia Ltd (ASX: TMT).

This will see Australian Vanadium acquire all of Technology Metals' shares, with all shareholders to receive 12 Australian Vanadium shares for every Technology Metals share owned. According to the release, this implies an offer price of 32.4 cents per Technology Metals share. Technology Metals (which is also in a trading halt today) last traded for 29.5 cents per share on Friday.

As per the announcement today, the Technology Metals board has "unanimously recommended" the merger to shareholders and will be voting in favour of the merger in the absence of a superior offer.

The merged company will continue trading as Australian Vanadium if all goes to plan.

Australian Vanadium price on ice as merger gets underway

In addition to this news, Australian Vanadium also announced a capital raising in the form of an institutional share placement in order to raise $15 million. According to the company, this will "fund ongoing project and corporate initiatives during the transaction period".

Australian Vanadium told investors that, "the combination of AVL and TMT will create the leading Australian vanadium developer and will provide maximum flexibility to realise the full value of the asset base as a result of operational and corporate synergies expected to arise from consolidation into a single, integrated operation".

Here's some more of what Australian Vanadium CEO Graham Arvidson had to say about today's news:

The combination of Australian Vanadium and Technology Metals Australia is transformational for both

companies and marks a significant milestone in both management teams' efforts to develop their respective projects. The logical consolidation of two adjoining projects on the same orebody will unlock material synergies for both sets of shareholders.If successful, the transaction will create the leading ASX listed vanadium developer and a world-class asset of scale located in a Tier-1 mining jurisdiction. AVL's institutional placement ensures that the combined group will be well-funded to progress integration and the go-forward development strategy…

The transaction will leverage the best of both organisations, including best in class technical work, assets and people, and will result in AVL becoming the leading force in the Australian vanadium sector.

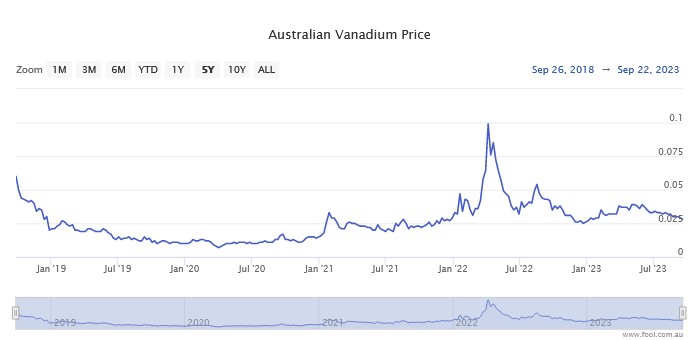

The Australian Vanadium share price has had a tough year in 2023, losing 10% of its value year to date. Over the past five years, the Australian Vanadium share price is down 46%, as you can see below:

The Technology Metals share price has seen a similar trajectory in recent years. Technology Metals shares are down around 15.7% over the past 12 months, and have lost just over 48% over the past five years: