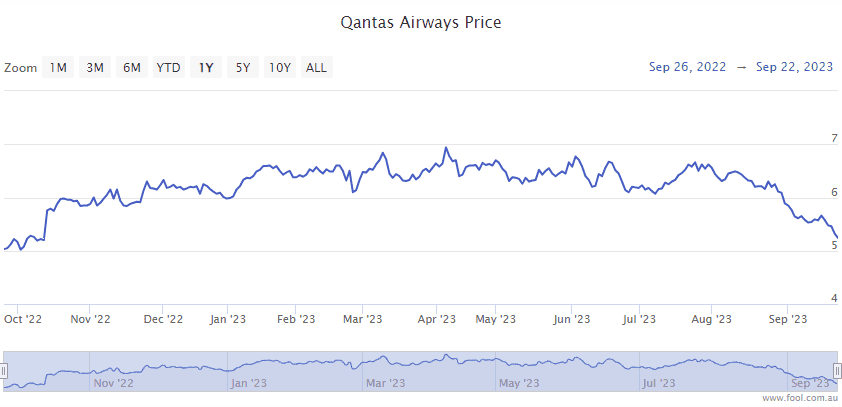

The Qantas Airways Ltd (ASX: QAN) share price is in the red on Monday morning.

Shares in the S&P/ASX 200 Index (ASX: XJO) airline stock closed at $5.31 on Friday. At the time of writing, they are swapping hands for $5.21 apiece, down 1.88%.

For some context, the ASX 200 is down 0.38% at this same time.

As you're likely aware, the Qantas share price has faced headwinds on a number of unwanted fronts over the past weeks.

These include allegations from the Australian Competition and Consumer Commission (ACCC) that Qantas sold tickets to flights that were already cancelled, and the Federal Court ruling that the airline illegally fired 1,700 workers, outsourcing their jobs during the pandemic.

The ructions saw a big fall in the Qantas share price and led to the earlier-than-expected departure of CEO Alan Joyce on 5 September.

Now, here's how the ASX 200 airline's new CEO Vanessa Hudson intends to rebuild the company's brand and regain customer trust.

How is the ASX 200 airline aiming to rebuild trust?

This morning, Qantas announced a "material increase to investment in customer improvements".

The airline will invest an additional $80 million in customer improvements across the 2024 financial year. That's atop the $150 million already budgeted.

The Qantas share price could be under some added pressure today, with management noting the funding will come from profits.

Among the coming improvements travellers can expect, Qantas noted:

Better contact centre resourcing and training, an increase in the number seats that can be redeemed with Frequent Flyer points, more generous recovery support when operational issues arise, a review of longstanding policies for fairness and improvements to the quality of inflight catering.

Commenting on the airline's plans to rebuild trust, Hudson said (quoted by The Australian Financial Review):

We want to get back to the national carrier that Australians can be proud of, that's known for going above and beyond. We understand we need to earn your trust back. Not with what we say, but what we do and how we behave.

Hudson also apologised for the company's failings during this post-pandemic reopening.

"I think it's important to recognise that we have not delivered to our customers' expectations, and I think that that is the context of what is in my apology today," she said.

Qantas share price outlook

Looking to what could impact the Qantas share price in the months ahead, the company said it expects travel demand to remain strong, with similar trading conditions in Q1 FY24 as it saw in the last quarter.

The company also expects a 12% increase in international capacity from Qantas and Jetstar by the end of 2023, adding almost 50 flights a week from current levels.

A potential drag on the Qantas share price is the increasing cost of fuel, now up some 30% since May.

Management said if the prices continue, it will see a $200 million increase in the airline's fuel bill to $2.8 billion after hedging. Management also anticipates an additional $50 million impact due to non-fuel-related foreign exchange changes.