Polynovo Ltd (ASX: PNV) shares have struggled to find support in 2023. After a brief reprieve between May and August, the wound treatment company has seen its share price slapped with a 22.3% decline over the last 29 days.

On Friday, shares in the Melbourne-based medical device maker arrived at a new 52-week low of $1.27. Since then, the Polynovo share price has inched higher to $1.30 but remains a far cry from its 52-week high of $2.70.

The poor performance in 2023 is peculiar, given that Polynovo is achieving record total revenue. Could the market be unreasonably discarding this small-cap opportunity?

How 'cheap' are Polynovo shares?

Before getting ahead of ourselves, it's important to remember that 'cheap' or 'expensive' are traits only revealed in hindsight. A company can trade on premium multiples and still be a superior investment if the underlying business is exceptional. Conversely, the opposite can also ring true.

Unfortunately, we do not have the benefit of hindsight while we are in the present. If you do, please get in touch; I'd be delighted to know the future.

Alas, we are left to try and establish an objective determination on Polynovo's 'cheapness' or lack thereof. This is made more difficult due to the company's unprofitable operations. The commonly applied price-to-earnings (P/E) ratio will be of no use here.

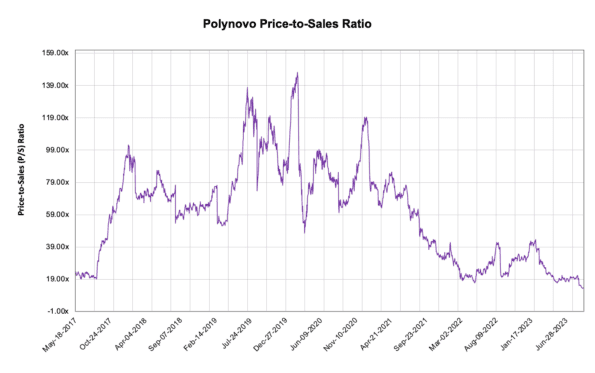

Instead, we could turn to the more dubious valuation yardstick… the price-to-sales (P/S) ratio. I say dubious because sales (or revenue) is not what shareholders get to pocket. Paying a premium for sales that do not convert into profits can come with pitfalls.

In saying that, Polynovo shares are currently trading at their lowest P/S multiple in their listed life.

At around 14 times sales, the company is more richly valued than Nanosonics Ltd (ASX: NAN) while trading at a lesser premium to Impedimed Limited (ASX: IPD) and Anteris Technologies Ltd (ASX: AVR).

The record low P/S multiple is a byproduct of revenue growth outpacing the Polynovo share price in recent years. From FY20 to FY23, revenue increased roughly threefold from $22.2 million to $66.5 million.

What are the analysts saying?

Analysts at Morgans commenced coverage of Polynovo last week with an add rating.

Furthermore, the team holds a rosy outlook on Polynovo shares, appending a $1.88 price target on the medical device company. This would suggest a potential 44.6% upside to the current Polynovo share price.