This logistics software company continues to live up to its ASX 'darling' status. Today, the WiseTech Global Ltd (ASX: WTC) share price eclipsed its former record to grasp a new all-time high.

Joining a raft of companies setting new 52-week highs, WiseTech shares have smashed through to $84.26 apiece — after a slow start to the day — rallying 2.4% in the process. The solid performance outpaced the 0.85% gain paraded by the S&P/ASX 200 Index (ASX: XJO).

Breaking into unexplored heights once again, WiseTech shareholders have enjoyed a fruitful 2023. This year, the tech company is the third best-performing stock in the index.

Yet, according to some analysts, the music could keep playing at this party.

'Incredibly important' platform

WiseTech has yet to release any price-sensitive information since its February results. However, that hasn't stopped analysts at UBS from establishing their bullish view of the software company and labelling it a buy.

Recently, the UBS team flagged how important WiseTech's CargoWise One platform had become to the global logistics industry. The sensational recurring revenue growth presented by WiseTech is emblematic of this, with analysts expecting this importance to continue.

CargoWise revenue grew by 50% to $289.2 million in the first half — making up 76.5% of the company's total revenue. It seems the WiseTech share price has been running on the fumes of this result since, in the absence of any further update since then.

Investors will find out whether the pace has been maintained on Wednesday, 23 August, when the company is slated to release its full-year results for FY23.

Another Australian fund manager riding the WiseTech wave is Hyperion Asset Management.

According to its June monthly update, the Hyperion Australian growth companies fund held an overweight position in the exuberant tech business. Compared to a benchmark weighting of 0.6%, Hyperion held an 8.2% allocation, making it the fifth largest holding in the fund.

What to watch for the WiseTech share price

Unless WiseTech releases an update before its earnings, all eyes will be on its full-year results to justify the price-to-earnings (P/E) ratio of 121 times. Investors will likely hope to see more of those face-melting growth rates for revenue and earnings.

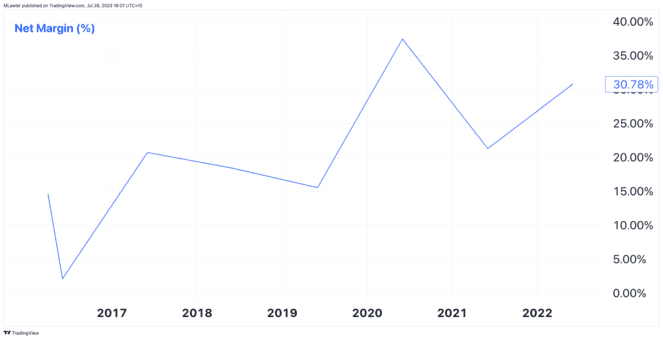

In addition, further evidence of operating leverage will be important. In simple terms, the company's net profits after tax (NPAT) increasing faster than revenue. This has been demonstrated by WiseTech's profit margin trending higher over the years, as shown below.

The WiseTech share price is up 70.9% in 2023. If analysts are on the money, more upside could still be on the cards this year. UBS analysts currently have a $85.90 price target on the software provider, suggesting an additional 2% move from its current all-time high.