The All Ordinaries Index (ASX: XAO) has delivered a solid 4.5% return before dividends this year. Yet few investors may know the ASX All Ords share that has outpaced the benchmark by more than 59% in 2023.

Providing an essential service to the economy, Lindsay Australia Ltd (ASX: LAU) is a transport, logistics, and rural supply company operating nationwide. Stare long enough out the car window on your next road trip, and there's a good chance you'll see the business in action.

So, why is a humble 70-year-old transport company crushing index returns, and could it still be worth tagging along for the ride?

What's impressive about this ASX All Ords share?

In the past, Lindsay Australia had not been a business that attracted much excitement among investors. After all, the company's shares mostly traded sideways between 2016 and 2021. However, as famed investor Peter Lynch said, "Focus on the companies, not on the stocks."

Between 2016 and 2021, revenue gradually grew from approximately $318 million to $494 million. Onlookers may not have paid much attention due to the slim profit margins throughout this period — never exceeding 2.5%.

That soon changed in 2022 as Lindsay posted figures showing profit growth that had outpaced its top-line growth.

This is a theme that has carried over into this year. In its half-year presentation, the company grew its operating revenue by 23.2% while its statutory net profit after tax (NPAT) increased by approximately 38%.

More recently, it looks as though this ASX All Ords share is determined to put its newfound profits to work. The company announced its acquisition of leading rural merchandise business WB Hunter earlier this week.

Forking out $34.6 million, the deal will see Lindsay expand its rural merchandising footprint in Victoria and New South Wales. According to the release, WB Hunter will beef up the company's pro forma FY24 earnings per share (EPS) by a high single-digit figure.

Motley Fool contributor Darius Zarghami considered the deal a positive one, stating:

Lindsay Rural represents a key component in the company's end-to-end food supply chain solution, making this an attractive acquisition for the company. In particular, by strengthening its competitive advantage through further scale and depth of product offerings.

What about the valuation?

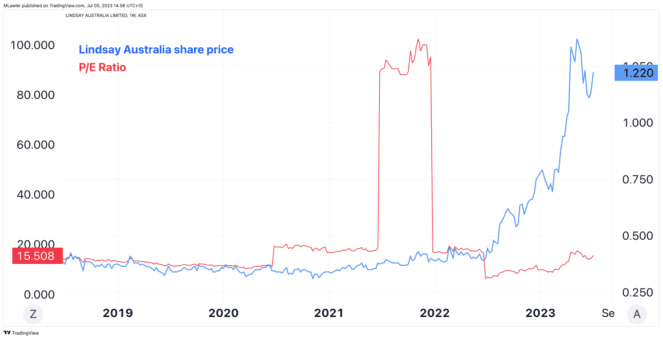

The company's valuation should be considered before an investor can decide whether it's too late to buy Lindsay Australia shares. There are many factors to weigh up when undertaking this fundamental analysis, though the price-to-earnings (P/E) ratio can be an excellent place to start.

As shown below, the company's earnings multiple has steadily risen over the past year. Still, the 15.5 times multiple it trades at aligns with the global transportation industry average.

However, analysts forecast this ASX All Ords share to grow its annual profits to $48.7 million in FY26. If it were to achieve this milestone, today's price would reflect a forward P/E ratio of around seven times FY26 earnings.