If you want to get a pulse check on Sayona Mining Ltd (ASX: SYA) shares, looking at the trades made by people who are working inside the belly of the beast is often a good place to start.

These people are the decision-makers. The ones who are living and breathing the business day in, day out. Ultimately, the company's directors have a front-row seat to all the action, creating a more tangible feel on the future fortunes of the business. It would be remiss to believe otherwise.

So, have Sayona insiders been ditching their shares, or loading up over the last 12 months?

Buying up or cashing out?

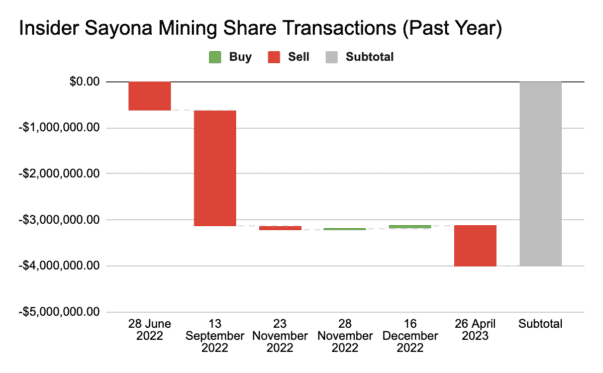

Digging into on-market director trades occurring over the last year, six transactions in Sayona Mining shares land on our radar. These trades were carried out by three insiders: CEO Bretty Lynch, company secretary Paul Crawford, and non-executive director Allan Buckler.

Cashing out a total of $1.6 million worth of shares, Lynch sold down his stake on 28 June 2022, 23 November 2022, and 26 April 2023. However, it is important to note that the CEO also exercised options and was issued shares totalling $1.41 million during this time.

Notably, the single largest trade was a sell order actioned by Buckler. Selling 7 million Sayona Mining shares, the director made a cool $2.52 million on 13 September 2022.

The remaining insider trades carried out by Crawford were two modest buys in November and December last year. These transactions were valued at $56,375 and $55,000 respectively.

In aggregate, Sayona insiders sold approximately $4.01 million worth of shares through on-market transactions, as shown in the waterfall chart above.

Sayona Mining shares are not too bothered

While company directors were selling, some chose to go one step further and short the pre-revenue company. At a market capitalisation of more than $1 billion for the majority of the last 12 months, some had positioned to benefit from a correction.

However, shares in the lithium hopeful have seen their short interest fizzle out over the past couple of weeks. In the latest 10 most shorted ASX shares article, Sayona is nowhere to be seen. This contrasts with fourth place, with an 8.25% short interest, in the prior list.

In fact, Sayona Mining shares have outperformed the broader market over the past year. At the time of writing, the 1-year gain stands out at 38.5% compared to the benchmark's 13.6%.