US stocks have headed in the direction that one particular market indicator has gone in 26 out of 26 cases over the past 73 years.

It's never been wrong.

As the old disclaimer goes, past performance is not necessarily indicative of future performance, but maybe this is the exception?

Are US stocks about to go up or down?

The indicator we're referring to is the S&P 500 Index (SP: .INX).

The S&P 500 comprises the 500 largest companies listed on the New York Stock Exchange.

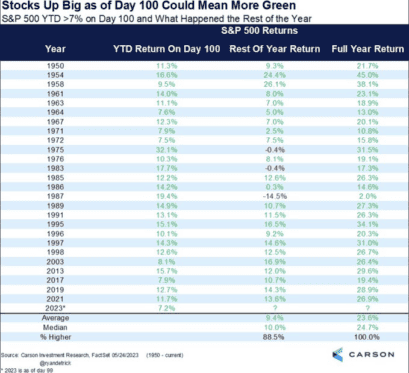

As pointed out in a tweet last month by Carson Group's chief marketer Ryan Detrick, the S&P 500 has always stayed in the green if it's trading 7% or higher on the 100th trading day of the year.

When it's trading like that, it averages a 23%-plus return for the full year, too.

The 100th trading day for US stocks was 25 May. And guess what happened last week?

US stocks officially entered a new bull market.

What makes this a bull run?

As we reported, the S&P 500 Index (SP: .INX) has now lifted 20% from its most recent low in October last year. A 20% recovery indicates a new bull run has started.

The Dow Jones Industrial Average Index (DJX: .DJI) entered a new bull phase in November, and the Nasdaq Composite Index (NASDAQ: .IXIC) did the same in May.

As the old saying goes, when US stocks sneeze, ASX shares catch a cold. So when US stocks roar, it's surely just a matter of time before ASX stocks follow?

As the chart above shows, the S&P 500 is up 13.5% in the year to date. By comparison, the S&P/ASX All Ordinaries Index (ASX: XAO) is up just 2.7% over the same period, as seen in the chart below.

However, it's worth noting that there were hopes in May that the US Fed was done with raising interest rates, which may have contributed to the S&P 500 rising in recent weeks.

As reported by CNN, the Fed's May statement included mention of "determining the extent to which additional policy firming may be appropriate".

This language was quite different from the March statement, which said: "The committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time."

Here in Australia, however, Reserve Bank Governor Philip Lowe has indicated we may have further to go on rates.