This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) stock has had a legendary run over the past decade. Its price has risen an astounding 663%, 1,150%, and 7,940% over the last three, five, and 10 years, respectively. Started in 1993 by Jensen Huang, Nvidia began in PC graphics and changed the world when it introduced the graphics processing unit (GPU) in 1999. Huang still leads Nvidia, and the company is as impressive as ever.

With its meteoric rise over the past decade and a market cap of more than $750 billion, have investors missed the boat on benefitting from Nvidia's growth? Let's take a closer look and see if we can find the answer.

The many uses for GPUs

GPUs were originally designed to speed up 3D graphic processing. However, these semiconductor chips eventually found other uses, such as serving as the backbone for data centers and artificial intelligence (AI) applications, because of their incredible computing power. Nvidia competes with Advanced Micro Devices in creating the most powerful GPUs, but Nvidia runs away with the title. Just check any "best gaming PC GPU" tier list and it will be filled with different Nvidia models.

Showcasing Nvidia's dominance, the TOP500 project ranks the "world's 500 most powerful computer systems." Nvidia's technology powers more than 70% of them and is being used in 90% of new ones being built. This industry dominance showcases how far Nvidia is in front of its competitors.

The GPU use case is only increasing. Data centers can increase their speed while utilizing less power with Nvidia's GPU acceleration. Engineering simulations like those run using software maker ANSYS products are powered by GPUs and are being put to use in designing the next generation of products. An investment in Nvidia is a bet on technological advancement.

Nvidia agreed to purchase semiconductor and software design company ARM for $40 billion from SoftBank back in 2020, but regulators are still examining the deal for antitrust compliance. The target close date is March 2022, but Huang believes it could even be later before regulators give it the OK. This huge deal would combine ARM's CPU processors with Nvidia's GPUs, giving Nvidia a significant grasp on every consumer electronic item, which is why regulators are assessing the deal intensely. Should the deal go through, ARM would have access to Nvidia's vast research and development capabilities. In the acquisition announcement, Huang said, "Our combination will create a company fabulously positioned for the age of AI."

The applications for Nvidia are nearly unlimited, and it is working on integrating its products into many exciting fields.

Stunning growth

Nvidia put up spectacular growth numbers during its last quarter despite how large it is. Revenue was $7.1 billion, up 50%, bringing its trailing-12-month revenue to $24.3 billion. For a hardware company, its gross margin is an astounding 65%. This allows it to produce massive amounts of cash because it has more than enough to cover expenses. Nvidia converted 18% of sales into free cash flow, adding to its already large $19.3 billion cash stockpile.

Breaking down the revenue into segments shows how diversified Nvidia is.

| Category | Q3 FY22 | Q3 FY 21 | Growth (YOY) |

|---|---|---|---|

| Gaming | $3.22 billion | $2.27 billion | 46% |

| Data Center | $2.94 billion | $1.90 billion | 55% |

| Professional Visualization | $577 million | $236 million | 144% |

| Auto | $135 million | $125 million | 8% |

| OEM & Other | $234 million | $194 million | 21% |

Source: Nvidia. YOY = Year over year.

The quickest growing segment -- professional visualization -- concentrates on applications such as engineering, media creation, and Nvidia's omniverse. The omniverse is similar to the metaverse but for professionals. It allows visualizations of 3D workflows, like manufacturing, architecture modeling, and video game creation. Over 700 companies have evaluated this product in its open beta stage, and 70,000 individuals have already downloaded it. While it is a small segment, its growth potential is exciting.

Is it too expensive?

Buying a stock that is executing well is smart, but only if it can be bought at the right price.

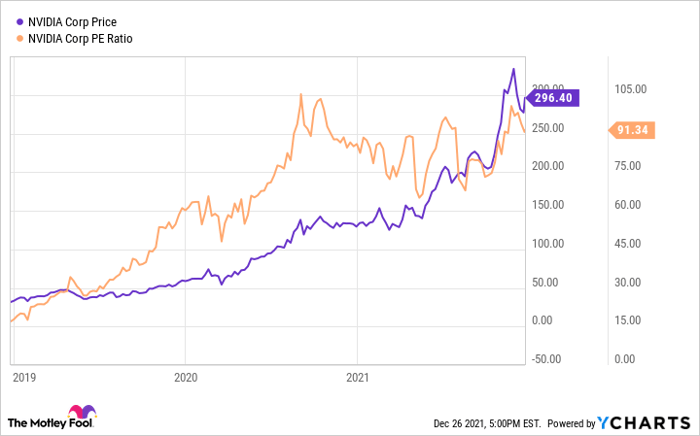

NVDA data by YCharts

Nvidia's price-to-earnings (P/E) ratio has skyrocketed along with its price, meaning most of its gains were generated by multiple expansions. This occurs when the market believes a stock should be more highly valued because of its execution or market opportunity. However, its valuation reached the 75-to-90 P/E range during mid-2020 and hasn't fluctuated much beyond that even as the stock price rose, meaning earnings were rising to reflect the price change.

For a company with strong execution and growth prospects like Nvidia, I think today's price is very expensive, but it's still OK to purchase if your time horizons are set appropriately. Also, Nvidia is practically an earned monopoly. While alternatives exist, Nvidia is the best, and an upstart would take years to achieve what Nvidia has done. Nvidia's growth prospects span many decades, so investors should at least hold the stock for five years to allow the company to execute some of its vision. The stock price has slid about 10% over the last few weeks, so it may be a great buying opportunity for this growing company.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.