The CSL Limited (ASX: CSL) share price got through the week unscathed, closing on Friday 1% higher to $315.50.

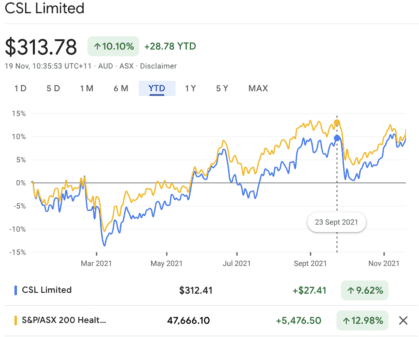

Shares in the global biotechnology company have now recovered to 3-month highs after slipping off the cliff-face back in September. Their investors gave up $26 a share in the course of a week, amid a wide selloff in the ASX 200 healthcare sector.

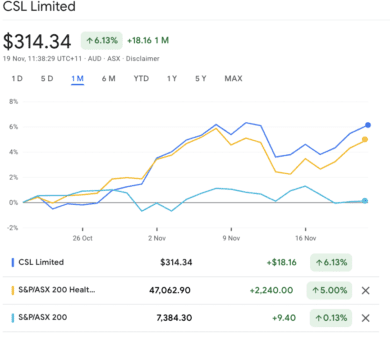

Whereas the S&P/ASX 200 Health Care index (ASX: XHJ) has gained around 5% this past month, the CSL share price has climbed 7%, with just one slight hiccup along the way.

Both have soared well past the benchmark S&P/ASX 200 Index (ASX: XJO)'s gain of just 0.2% at the time of writing.

CSL share price vs S&P/ASX 200 Health Care index YTD

Source: Google Finance. Google and the Google logo are registered trademarks of Google LLC, used with permission.

CSL is one of Australia's success stories. Established over a century ago, it now labels itself as a biotechnology leader, with a dynamic portfolio of life-saving products and a reputation for putting patients first.

So with that in mind, let's take a closer look at what the experts are saying about the outlook for CSL investors.

Blood plasma problems?

CSL is one of only a handful of large plasma collection companies in the world, and the bolus of its revenue comes from collecting blood plasma out of the United States.

In fact, in late October it was announced the company opened its 300th US plasma centre through its subsidiaries there.

Plasma donations are essential to modern-day medicine. They are used to produce therapies in a number of rare disorders. They are used in therapies for immunodeficiency, respiratory conditions, neurological disorders, and bleeding disorders such as haemophilia.

During the pandemic, plasma collection suffered a hit across the globe, due to government-enforced lockdowns in several countries.

The US in particular saw a massive decline, which had a flow-on effect for CSL due to its exposure there.

Fast forward to May 2021, where CSL was forced to increase the amount of cash it pays plasma donors in the US after collection volumes continued to fall sharply.

CSL's US competitor Haemonetics Corporation (NYSE: HAE) recently lowered its own plasma-grown guidance for the upcoming year as well. As such, CSL's plasma collection forecasts might be slightly overly optimistic, according to the team at Morgan Stanley.

What are the experts saying?

The investment bank notes it is modelling a 32% increase in quarterly plasma collections at CSL. However, it thinks the forecasts might be a bit top-heavy given Haemonetics' result.

It reckons this could be a threat to CSL's revenue in FY23, given the time gap between cash receipts for plasma collection and the end product. Haemonetics also noted the "delay in the acceleration of plasma collections in the quarter" in its earnings call.

Morgan Stanley notes although "it's early days, and collection trends appear volatile, recent data points could suggest at least some risk". It has a $280 price target on CSL shares.

Analysts at JP Morgan agree. It notes Haemonetics' results fell well short of internal estimates, and this poses a risk to earnings estimates on CSL.

The firm also notes that respiratory and COVID-19 infections are on the rise again in Europe and South East Asia. It says the "Immunisation Colonisation is predicting a tough flu season next year for Australia as international travel resumes and COVID-19 restrictions are eased". Most of CSL's vaccine revenue comes from "Northern Hemisphere flu season", it notes.

Researchers at both firms are reserved on CSL. Each of the investment banks believes Haemonetics' results could spell a slower recovery in plasma collection to pre-COVID levels.

Morgan Stanley values CSL at $280/share, whereas JP Morgan has a slightly higher valuation of $285/share. Each holds an equal weight and neutral rating respectively.

What's the sentiment on CSL's share price?

Of the 17 brokers covering CSL, there are 9 that recommend the share as a buy or are bullish on the direction of its share price.

This has remained fairly consistent over the past 2-year period. However, it is sitting below the number back in April and May of this year.

So far this month, CSL is gaining ground once again. It is up again for the month and is beating each of the broad indices.

CSL winning the race this past month

Source: Google Finance. Google and the Google logo are registered trademarks of Google LLC, used with permission.

The average price target is $316 from the group, implying an upside potential of around 0.16% on Friday's closing price.

However, the spread between the highest and lowest price targets is $72 per share, or 25%. Morgan Stanley and JP Morgan are each the most reserved on the CSL share price with respect to their group's valuation.