Peppermint Innovation Ltd (ASX: PIL) shares are bouncing around today after the company provided an update regarding the launch of a new insurance offering.

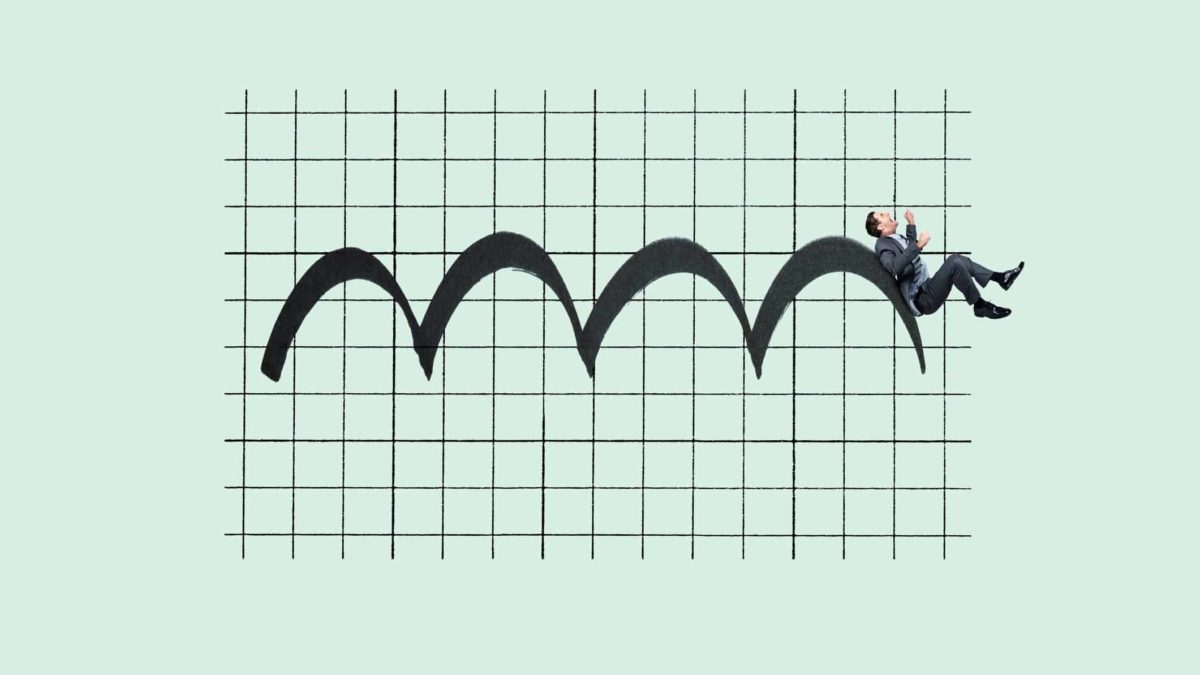

In early trade, the Peppermint share price surged by around 13% to 2.6 cents only to then retreat. At the time of writing, Peppermint shares are trading at 2.3 cents, flat for the day so far, amidst a wider market selloff.

Let's take a look at what the mobile banking app developer announced.

Peppermint offers new micro-insurance product

The Peppermint share price has been up and down today after the technology company announced it has entered into an agreement with Cebuana Lhuillier Insurance Solutions (Cebuana) in the Phillippines. Peppermint is now offering Filipino consumers access to life and accident insurance products.

Under the agreement, Cebuana will provide the insurance products and services to Peppermint. Peppermint will provide marketing and sales services as well as collect premiums and be responsible for compliance.

Using Peppermint's bizmoto app technology, customers will have access to three different micro-insurance products to purchase on a monthly or annual basis.

Every policy covers emergency services associated with coronavirus.

CEO comments

Peppermint managing director and CEO Chris Kain said:

Offering accessible and affordable insurance products is an extremely important part of Peppermint's overall vision to deliver financial inclusion and social good to the Filipino people…

The aim of bizmoProtect is to deliver affordable and accessible accident and life insurance to Filipino people via our established bizmoto agent network using our new and improved bizmoto mobile App…

bizmoProtect represents the first product to be launched within our targeted financial services business sector and means that our bizmoto ecosystem is now live across all of the four key targeted business sectors of mobile payments, e-commerce, delivery and logistics and financial services.

Peppermint will receive a 5% or 10% service fee for all premiums collected and a 60% share of product mark up.

Peppermint share price snapshot

Peppermint Innovation services the Philippines market and is focused on the commercialisation and further development of its mobile banking, delivery and logistics, e-commerce and finance technologies.

The Peppermint share price has fallen by more than 20% over the past month. This comes following an explosion in the price of Peppermint shares in late January when the company resumed trading on the ASX after an extended halt.

Based on the current share price, Peppermint has a market capitalisation of around $37.4 million and there are presently 1.4 billion shares outstanding.