There are some positive signs for Australia's jobs market as new data from the Australian Bureau of Statistics (ABS) reveals a slowdown in COVID-19 job losses.

The ABS has been collecting payroll and wages data in Australia as part of its effort to shed some light on the impact of COVID-19 on people and businesses across the country.

What the numbers say

According to the ABS, total payroll jobs fell by 7.3% between 14 March 2020 and 2 May 2020. In the same period, total wages paid decreased by 5.4% compared to an 8.2% drop in the ABS' previous report, largely propped up by the JobKeeper payment.

According to March unemployment data, some 13 million Australians were employed in mid-March. So, this reported 7.3% fall equates to around 950,000 job losses over the 7-week period.

The hardest-hit states were Victoria and New South Wales, where falls in job numbers were around 8.4% and 7.7%, respectively, over the 7-week period. In terms of wages, Western Australian fared the worst with a 7% fall in total wages, while Victoria wasn't far behind with a 6.7% decrease.

At an industry level, the accommodation and food services industry had lost around a third of payroll jobs by the week ending 11 April. A subsequent increase in jobs saw this reduce to around 27.1% by the week ending 2 May.

Similar improvement has been seen in the arts and recreation services industry, where a previous fall of 27% is now a (still significant) 19% slump.

Tentative signs of improvement

Commenting on this new data, Bjorn Jarvis, Head of Labour Statistics at the ABS, said: "The latest data shows a further slowing in the fall in COVID-19 job losses between mid-April and early May."

"The week-to-week changes are much smaller than they were early in the COVID-19 period. The decrease in the number of jobs in the week ending 2 May was 1.1 per cent, which was only slightly larger than the 0.9 per cent increase in the week ending 25 April," Mr Jarvis added.

What does this mean for ASX shares?

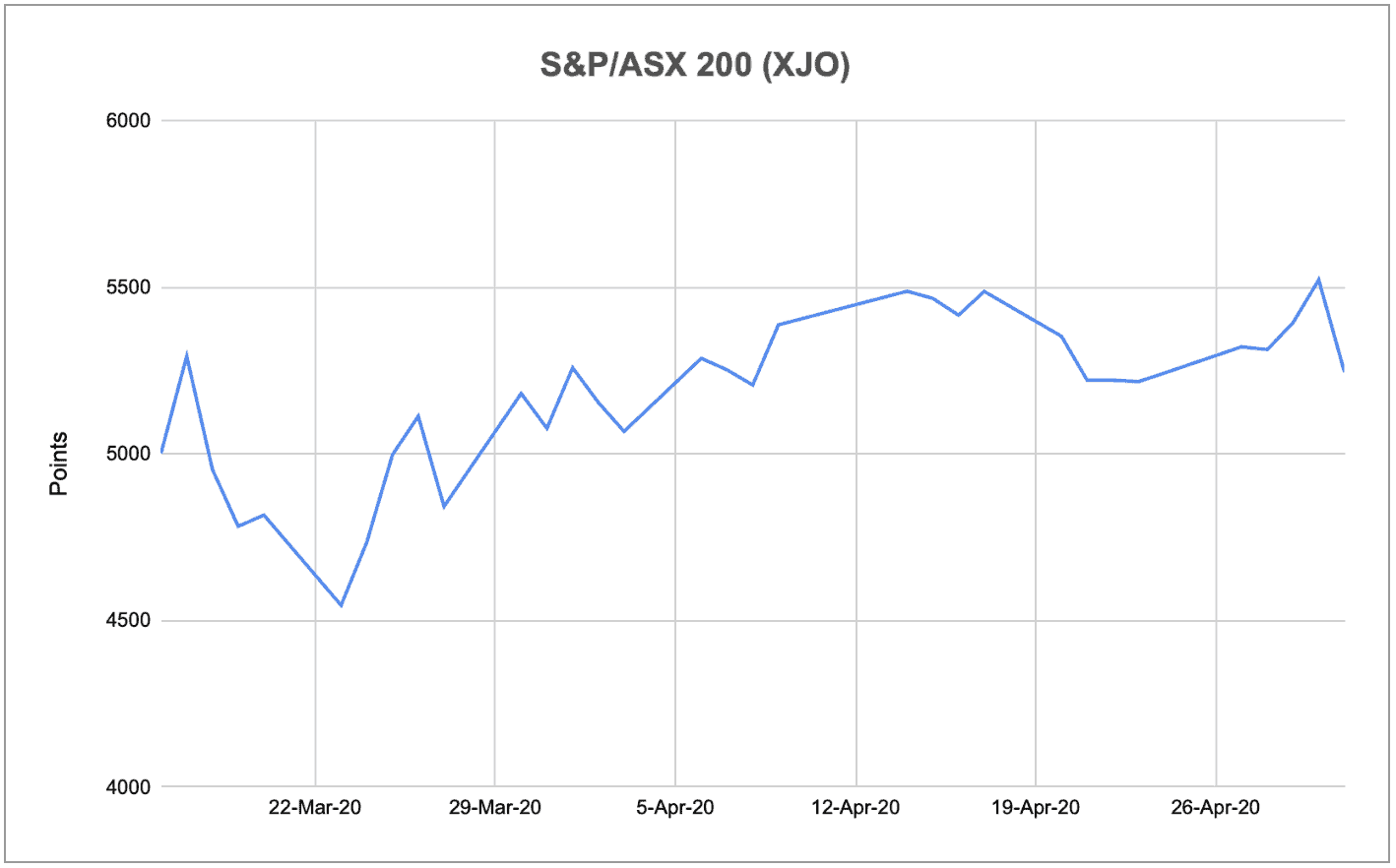

Over this 7-week period, the S&P/ASX 200 Index (ASX: XJO) initially fell to a bottom on 23 March before emerging out of its bear market and marching higher (albeit with many bumps along the way):

The ASX 200 has continued to climb in the interim, just yesterday jumping 1.81% to close at 5,560 points, buoyed by COVID-19 vaccine hopes.

As the economy wakes from hibernation, the effects of COVID-19 and the associated restrictions will begin to emerge through data points like the ones mentioned above. Generally speaking, the share market reflects the conditions of local and global economies – or at least perceived conditions and sentiment – for which employment and wages certainly play a part.