Investing is a tricky game and one that is impossible to perfect. Even great investors like Warren Buffett, Ray Dalio and Peter Lynch have all made mistakes during their successful careers. Even as recently as this year, Warren Buffett sold out of Berkshire Hathaway's airline companies, resulting in huge losses.

But even though no investor is perfect, there are still some mistakes we can all try to avoid making in order to increase the chances of long-term investing success.

One of the biggest mistakes any investor can make is to get emotional about their investments. Usually, when we talk about emotional investing, the pitfalls of buying as a result of euphoria and selling as a result of panic are the main topics of conversation.

But those are not the mistakes we'll be discussing today (although you should still heed them!).

Today, I want to talk about getting sentimental about investing. See, we normally regard investors who show a real interest in their companies as pretty shrewd. Loving a company and its products is a great way to find hidden gems the markets might be overlooking or underappreciating. It's how early investors in Afterpay Ltd (ASX: APT) might have discovered this gem ahead of the pack, for example.

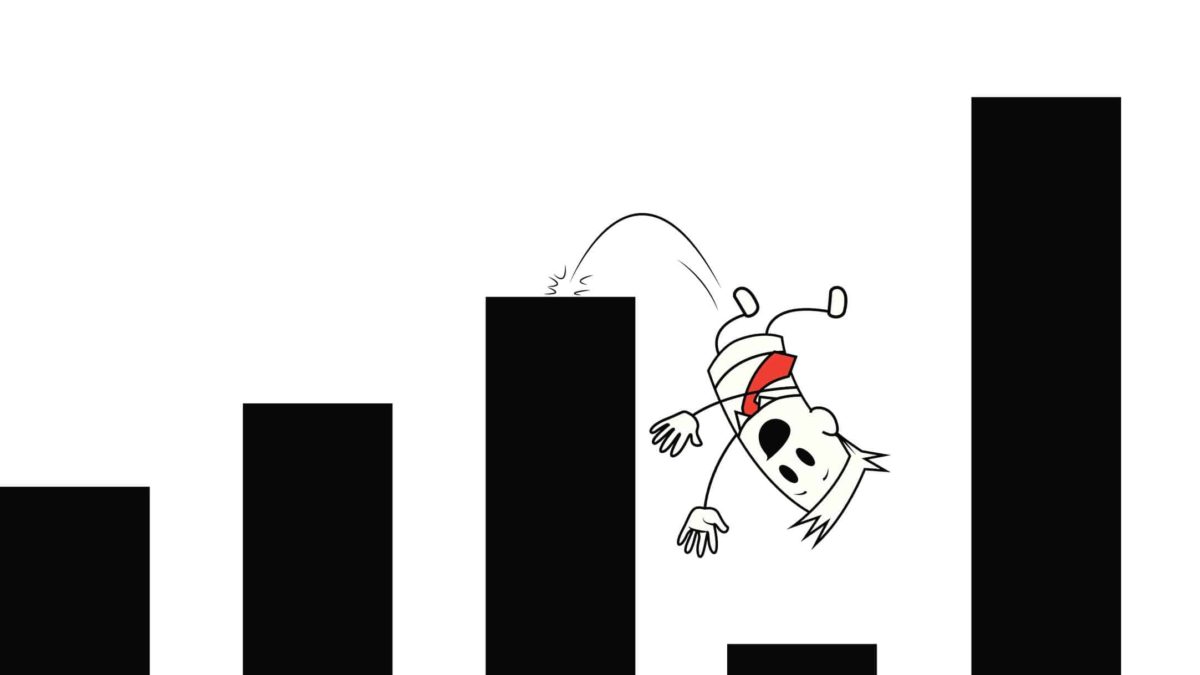

But there's a difference between having an emotional connection with a company and an emotional attachment. The latter is the one to avoid. See, if you get too emotionally attached to a company, you may be unwilling to sell your shares if things take a turn for the worse, even if it's logically the sound to do so.

Attachment – a mistake to avoid

One investor I know held shares of the old Fairfax Media Ltd (now defunct) for many years because they loved reading the newspapers Fairfax produced. Because of this devotion and attachment, they missed the writing on the wall, which was that the old business model newspapers were following was fast becoming obsolete. In hindsight, this investor let an emotional attachment get in the way of good investing practice. Perhaps they should have continued to buy Fairfax's newspapers, but sold out of their shares before they were acquired by Nine Entertainment Co Holdings Ltd (ASX: NEC) for a fraction of what they were purchased at.

Foolish Takeaway

Incidentally, I love reading newspapers too. But that doesn't mean I'm willing to invest in their future. You can always support a struggling company by buying their products instead of buying their shares! Letting sentiment and emotional attachment get in the way of prudent investing is a common mistake among ASX investors. Don't let it happen to you!