Nearmap Ltd (ASX: NEA) shares shed 15% to $2.66 this morning after the company reported a widening loss of $14.9 million compared to $11 million in the prior year.

The widening loss is due to growing sales, general and administration costs that climbed around $14 million. In addition $7.8 million of non-cash amortisation costs dragged the bottom line lower.

The cost blowout was to an extent offset by revenue growth of 45% to $77.6 million, however, it appears the market was expecting a better bottom line.

The good news is that almost every core operating metric for Nearmap continues to track in the right direction to suggest this is still a business that could grow profits strongly into the future.

In particular its annualised contract value (ACV) grew by $24 million or 36% to $90.2 million, with global subscriptions up a slightly disappointing 11% to 9,800.

Average revenue per user was up 23% to $9,208 pa, while churn fell to 5.3% compared to 7.5% in the prior year.

If ACV, average revenue per user (ARPU) and gross profit margins keep growing on the back of rising US sales while churn falls it is likely to boast profitability into the future.

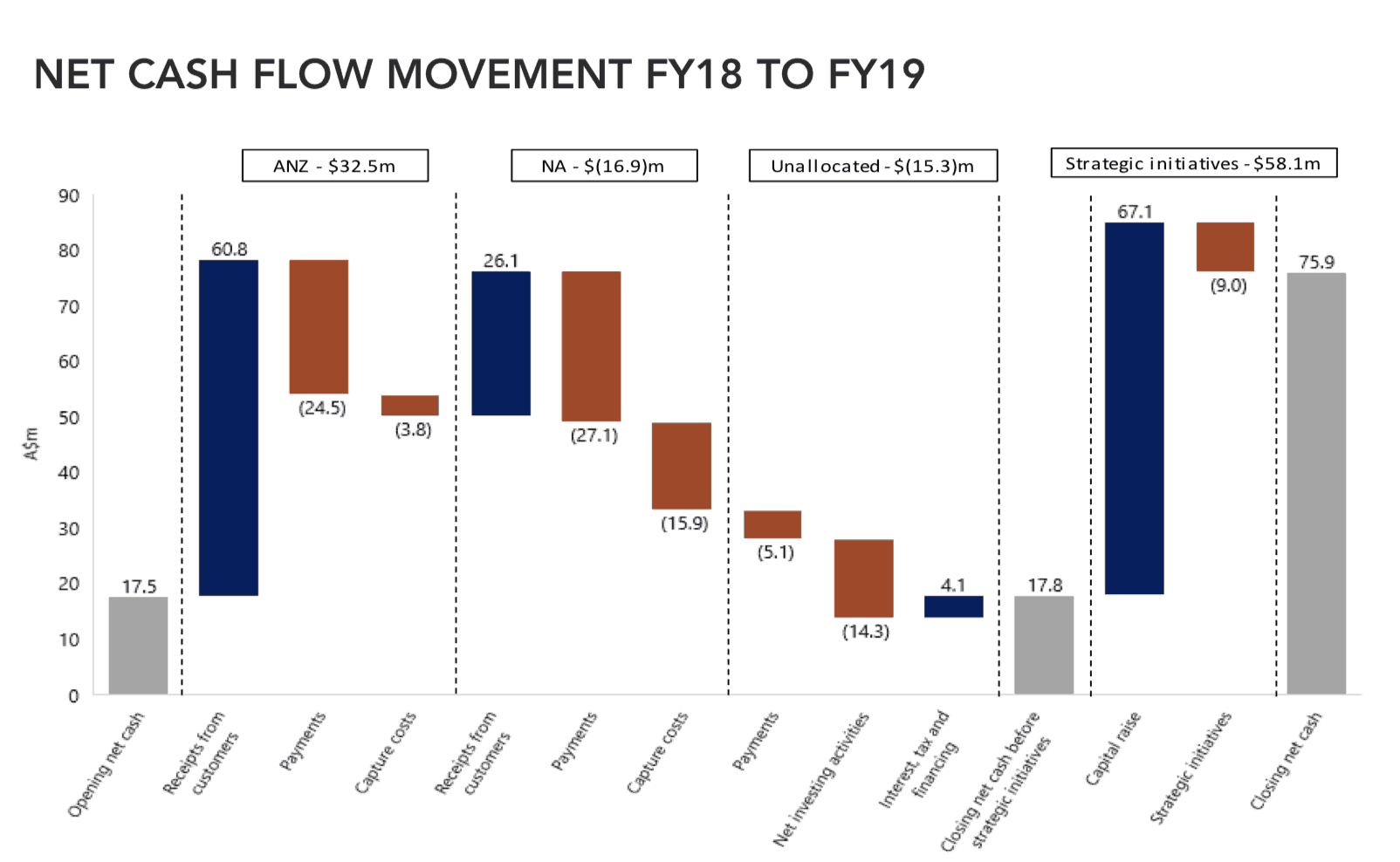

Importantly, the maturer ANZ business posted net cash inflows of $35.2 million over FY 2019 and its profitability can now self-fund the US group's growth and other corporate operating costs if necessary. The group already has a strong balance sheet with $75.9 million cash on hand to leave it well positioned. This is shown in the cash flow chart below.

Source: Nearmap presentation, August 21.

The US business grew ACV 76% to US$22.7 million in FY 2019 and this now represents 36% of the group's ACV portfolio.

The US is also a far larger market than Australia so it makes sense for the group to invest heavily for growth over the short term. Australian ACV grew 19% to $A57.9 million in a decent result as it continues its strong growth trajectory.

The group is also seeing plenty of up-selling to existing customers and rising ARPU as it has invested heavily in new 3D oblique mapping, artificial intelligence, and other data analytic solutions that bring more value to customers.

This helps widen Nearmap's moat and boost its long-term profit growth potential if it has really big ambitions.

The group has mapped 64% of the Canadian population, but provided no sales update, or guidance for FY 2020 in a move that has also disappointed investors.

Overall though the outlook seems positive for the business.