The CSL Limited (ASX: CSL) share price may be down today, but the future looks good after it revealed a huge pipeline of new products it's working on commercialising over the next three years or more.

In a 116 page presentation to investors this morning the company boasted of some recent clinical successes and a new product pipeline that could generate big profits for investors in the years to come.

So let's take a look at some of the key products it has in the works and when they might be commercialised:

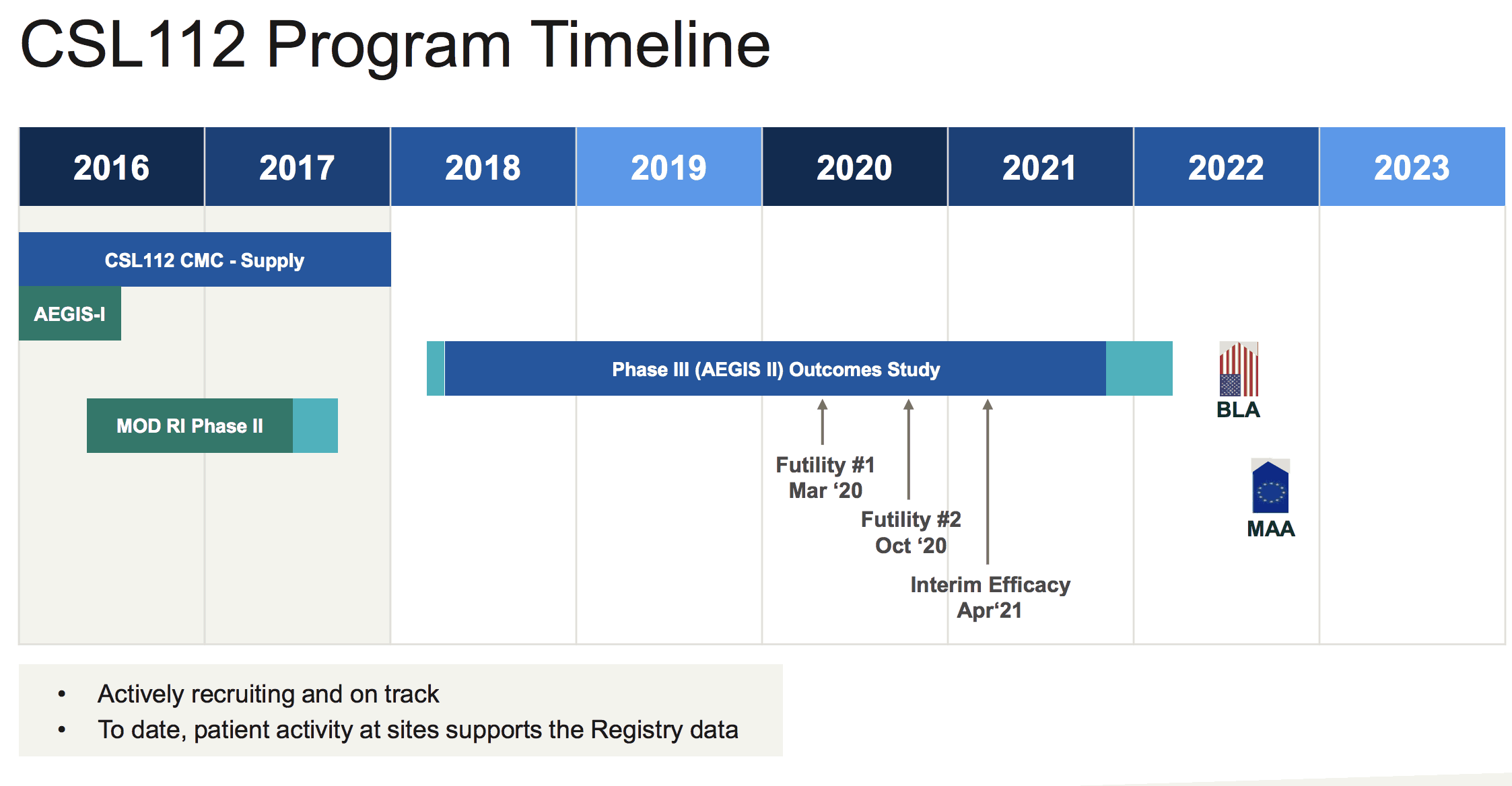

- CSL 112 – is a therapy to help heart attack vitamins with potential commercialisation from 2022, more on this below (Categorised as a potential 'breakthrough' medicine by CSL)

- CSL 312 – a "monoclonal antibody" at Phase II stage in development "for use in multiple indications including as a subcutaneous therapy for HAE" (hereditary angioedema) (Categorised as a potential 'breakthrough' medicine by CSL)

- CSL 346 – "A humanised mAb that antagonises VEGF-B and is administered via subcutaneous injection either as a standalone therapy or in combination with other agents for the potential treatment of diabetic nephropathy, or other conditions associated with aberrant lipid metabolism". (Categorised as a potential 'breakthrough' medicine by CSL)

- CSL 730 – a "novel recombinant human Fc multimer for treatment of patients with immune complex-mediated autoimmune diseases. Developed in collaboration with Momenta Pharmaceuticals."

- CSL 346 – "A humanised mAb that antagonises VEGF-B and is administered via subcutaneous injection either as a standalone therapy or in combination with other agents for the potential treatment of diabetic nephropathy, or other conditions associated with aberrant lipid metabolism."

According to its website and today's presentation CSL currently has a total of 30 different products at the pre-clinical, clinical trial, or product registration / launch stage, with $702 million invested in research and development over 2017-2018.

Its CSL 112 trial to help prevent secondary heart attacks in patients is recruiting more than 17,000 patients and it's investing more than US$500 million in total on the CSL 112 trials, with the interim efficacy result of the trial expected in April 2021.

If the trial meets its clinical endpoints then CSL hopes to have the treatment commercialised by 2022.

Source: CSL investor presentation, December 5, 2018

What the financial benefits of CSL 112 may be is unclear, but according to management it's a potentially transformational therapy with huge potential. Then again the trial may flop, so investors should be cautious.

In other positive news for investors today CSL also reported one of its cell-based flu vaccines sold under its Sequiris division showed better rates of immunisation for patients compared to more traditional egg-based flu vaccines.

CSL looks a good long-term bet for investors and the share price is well off recent highs.