The market may have dropped notably lower again but that hasn't stopped the Telstra Corporation Ltd (ASX: TLS) share price from storming higher today.

In morning trade the telco giant's shares are up 4% to $3.14.

Why are Telstra's shares storming higher?

As I mentioned here on Monday, Telstra's shares appear to have come under pressure at the start of the week in response to the release of the NBN's Corporate Plan for 2019-22.

That plan revealed that in FY 2019 it expects ~1.2 million brownfield premises to be activated compared to the 1.5 million brownfield activations achieved in FY 2018.

This led to Telstra advising that it "will assess the effect of the nbn co Corporate Plan 2019 on its outlook for FY19 and advise the market once that assessment is complete."

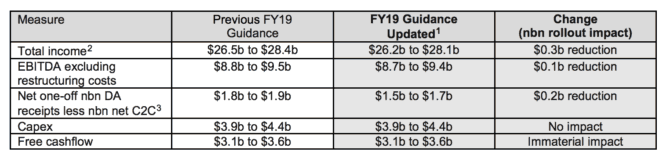

Although the lower activations mean that some Per Subscriber Address Amount (PSAA) receipts from the NBN in FY 2019 will be deferred into future periods, it is only going to have a modest impact on its full year guidance. This is shown on the table below.

The reason for this is that the deferred PSAA receipts will be partly offset by the natural hedge including benefits from lower NBN costs to connect, lower network payments to NBN, and retained wholesale EBITDA.

In addition to this, while the lower volumes impact Telstra's outlook for FY 2019, management anticipates these changes will be financially positive to Telstra over the full rollout due to the effects of the natural hedge.

This echoes what Goldman Sachs said earlier this week in a note. It also suggested that the lower activations would be a small positive for both TPG Telecom Ltd (ASX: TPM) and Vocus Group Ltd (ASX: VOC) for similar reasons.

Incidentally, the broker has a buy rating and $3.60 price target on Telstra's shares at present. This implies potential upside of almost 15% for its shares over the next 12 months, excluding dividends.

Should you invest?

While I think that Telstra is attractive at these levels, I would like some colour on its dividend plans before making a move. So for now, I would class it as a hold.