The IDP Education Ltd (ASX: IEL) share price has tumbled lower on Thursday and is down over 4% to $9.71 in early afternoon trade.

This follows the release of the full year results of the provider of international student placement and English language testing services.

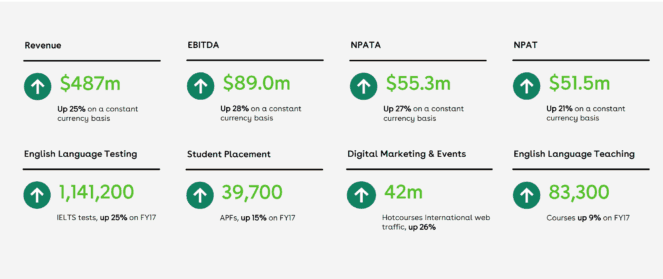

For the 12 months ended June 30, IDP Education reported total revenue of $487 million and earnings before interest, tax, depreciation, and amortisation (EBITDA) of $89 million. This was a 24% and 30% increase, respectively, on the prior corresponding period.

According to the release, the company delivered growth from all sides of its business thanks to the ongoing growth in the international education industry and the central role of English as a key global language. IDP Education has a global footprint and diversified business model which benefits from both of these trends.

The company's CEO and managing director, Andrew Barkla, believes the FY 2018 performance reinforces its leadership position in the international education services sector. He stated that: "These results reflect another impressive year for IDP as we delivered high quality services for international students and the broader higher education and English language sectors."

As you can see below, the company handled 1,141,200 IELTS tests during the 12 months, up 25% on the prior corresponding period. This led to a 22% increase in revenue to $306.8 million, equating to approximately 63% of its total revenue during the year.

Elsewhere, the company's Student Placing segment posted revenue growth of 19% to $122.7 million, the English Language segment saw revenue rise 5% to $22.2 million, and the Digital Marketing and Events segment more than doubled its revenue to $31.9 million.

This ultimately led to a net profit after tax of $51.5 million or NPATA of $55.3 million, up 24% and 30% year-on-year. NPATA is net profit after tax adjusted by adding back the non-cash post-tax charges relating to the amortisation of acquired intangible assets. Earnings per share came in at 20.1 cents.

Why are its shares lower?

Whilst this was undoubtedly a strong result, it is worth remembering that IDP Education's shares were up 91% over the last 12 months prior to today. It was always going to require something special to propel its shares higher, especially with its shares changing hands at 48x earnings.

I'm a big fan of IDP Education but I wouldn't be a buyer of its shares until management provides clearer guidance on FY 2019.

Instead of IDP Education I would suggest investors take a look at consumer discretionary growth shares such as Aristocrat Leisure Limited (ASX: ALL) or Domino's Pizza Enterprises Ltd (ASX: DMP).