You remember high school economics, right? The bit about supply and demand?

Okay, maybe I was just a little nerdier than the rest of you, but even if you weren't paying attention at the time, we all grasp the simple truth at the heart of economics: when more people want something than there is supply of that thing to go around, prices rise. And when no-one wants it any more, and there's excess supply hanging around, prices fall.

But enough about Bitcoin.

For years now, economists have wondered about whether inflation really was dead. At its worst, the argument has shades of the Monty Python sketch. Except that this time, the parrot really is sleeping. Yes, there were — are — reasons why prices have stayed low, including an underutilised workforce, changing consumer tastes, high debt levels and 'imported inflation' where some goods were getting cheaper thanks in no small part to lower wages and greater scale in other countries.

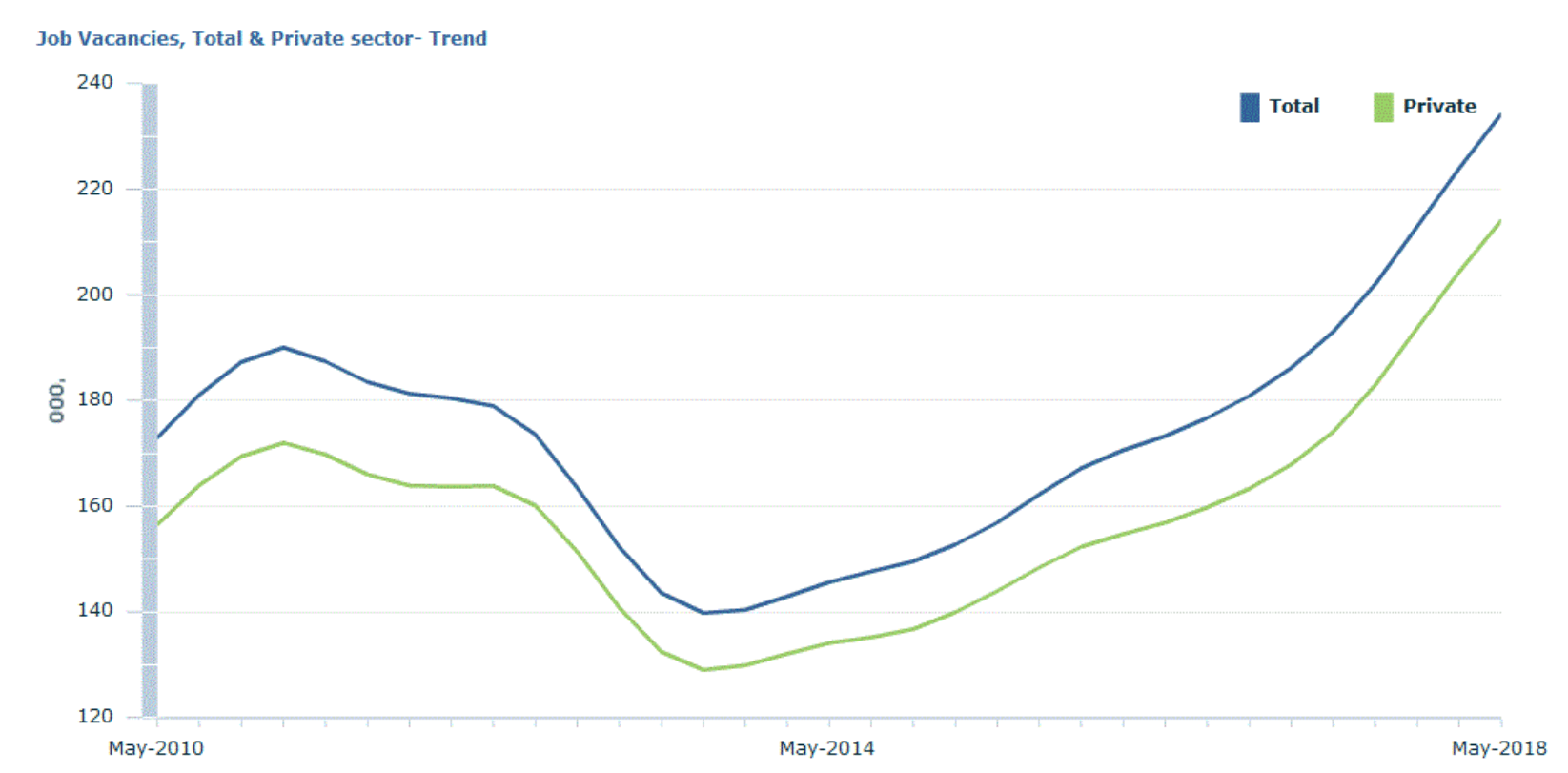

And lo, the parrot breathes. It stirs. And, according to data released yesterday by the ABS, its name is job vacancies:

As that chart makes clear, business is hiring. And in greater numbers than at any time during the last 8 years.

Now, back to supply and demand. A greater number of vacancies means that there are more jobs going than there are people to fill them, at least in relative terms.

And when there's more demand (vacancies) than people to fill them (supply)… well, we know what happens.

To be sure, wages haven't yet started to move in any significant, sustained way. But, contrary to the popular (mis)conception, the economy is nowhere near as bleak as some commentators would have you believe.

What happens when reality comes into contact with preconceptions and theories? I'll give you a tip… the latter struggles to keep up.

Now, it's always possible that a shock — internal or external — could bring our momentum to a shuddering halt. And it's not like there's an absence of potential ways in which that could happen (I'm looking at you, Donald, Kim, Xi and Vlad).

But, at least on the data we have in front of us, the economy is nowhere near as bleak as some would have you believe… and inflation is one likely result.