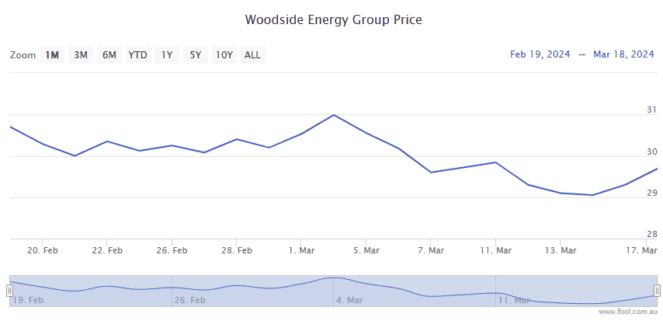

The Woodside Energy Group Ltd (ASX: WDS) share price is marching higher again today.

If the S&P/ASX 200 Index (ASX: XJO) energy stock holds these gains by close, it will mark four days of gains out of the last five trading sessions.

Shares closed up 2.3% yesterday and are up 1.2% as we head into the lunch hour today, trading for $30.62 apiece.

That sees the Woodside share price up 6.0% since last Wednesday's close.

For some context, the ASX 200 is down 0.2% over this same time.

Here's what's been piquing investor interest.

Why is the Woodside share price running hot?

Investors tend to buy Woodside stock when energy prices are on the rise. And sell when energy prices are falling.

Over the past week, as you can likely guess by the strong performance of the Woodside share price, the oil price has reached levels not seen since late October.

Brent crude oil is trading for US$87.10 per barrel today, up from US$81.92 per barrel last Wednesday.

At US$ 83.12 per barrel, West Texas Intermediate (WTI) crude is also at its highest levels since October.

The big spike in oil prices follows a series of Ukrainian drone attacks on Russian oil refineries.

According to JPMorgan Chase & Co (courtesy of Bloomberg), the drone attacks have knocked 900,000 barrels per day of Russia's refinery capacity out of action.

Adding to the potential supply-side crunch, Iraq has announced it intends to cut oil exports over the next months. This is to make up for producing more than it had agreed to in January and February under production limits with OPEC+.

And according to Jeff Currie, chief strategy officer of energy pathways at Carlyle Group, the oil price – and by connection the Woodside share price – could run significantly higher from here.

That's based on the assumption that the US Federal Reserve will begin reducing interest rates in 2024.

Should that eventuate, Currie believes the oil price will run significantly higher than consensus expectations of US$70 to US$90 per barrel this year.

"I want to be long oil and the rest of the commodity complex in this environment," he said.

Pointing to Europe's replenishing its oil stockpiles and China's efforts to boost its manufacturing sector, Currie said, "The upside here is significant."