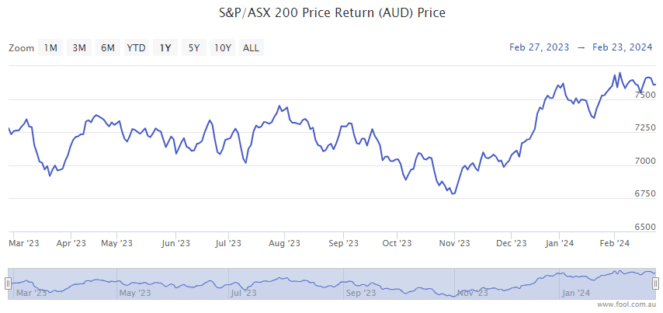

With the S&P/ASX 200 Index (ASX: XJO) up 9% since October, Aussie investors would do well to pay attention to Warren Buffett to cash in on the potential bull run ahead.

The Oracle of Omaha wasn't particularly wealthy when he began his career as a young man.

But by sticking to some surprisingly simple investing techniques, he became a billionaire by the time he was 56.

And he didn't stop there.

Now, aged 93 and still actively managing Berkshire Hathaway, Warren Buffett is worth more than US$137 billion (AU$210 billion), according to Forbes.

And with the Australian stock market looking like it may be set for a bull market in 2024, I aim to follow his advice to make the most of it.

Big barriers to entry

In his latest letter to Berkshire shareholders, Buffett wrote:

We want to own either all or a portion of businesses that enjoy good economics that are fundamental and enduring. Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes.

One of the core criteria Warren Buffett looks for to find a flourishing company is large barriers to entry for any would-be competitors. Or moats, if you will.

"In business, I look for economic castles protected by unbreachable moats," he says.

It's not surprising then that one of Berkshire's larger holdings is Coca-Cola Co (NYSE: KO).

The Sage of Omaha is not only a big daily consumer of the soft drink, but he also believes its moats are unbreachable.

"If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done," he's said.

Think long-term like Warren Buffett

Another valuable piece of advice for Aussie investors in the lead-up to a potential bull run on the ASX 200 is to keep thinking long-term and not try to second guess the market by chasing risky short-term gains.

"Our favourite holding period is forever," Warren Buffett once opined.

Commenting on Coca-Cola at the recent shareholders meeting, he doubled down on that advice, saying, "When you find a truly wonderful business, stick with it. Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable."

Keeping your eyes on the long-term horizon is a great way to cruise through the daily volatility of the share markets without getting spooked into selling near the lows or goaded into buying near the highs.

If you don't get it, don't invest in it

Another golden rule to keep in mind when the ASX 200 bull run kicks off in earnest is to stick to investing in companies whose business models you understand.

It's one of the reasons Warren Buffett won't invest in cryptos like Bitcoin (CRYPTO: BTC).

"You don't have to be smart, as long as you stick to what you know," he said.

But you do need to control the impulse to try and time the markets, which often sees investors buying and selling at inopportune times.

According to Buffett:

Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.