The Pilbara Minerals Ltd (ASX: PLS) share price is climbing this morning following some juicy news.

At the time of writing, shares in the lithium producer are up 5.2% to $3.56. Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is basking in a 0.74% increase.

Let's rummage through the release giving investors a jolt.

Please, Pilbara, may I have some more

Fresh off its quarterly update late last month, Pilbara Minerals is giving its shareholders another optimistic item today. This time, the news relates to an extension to an agreement struck last year with China-based lithium converter Chengxin Lithium Group.

For some background, Chengxin Lithium is a significant producer of lithium chemicals, supplying a vast assortment of customers. Its clientele includes prominently established names in the automotive and battery industries such as BYD, LG Chemical, CATL, and Hyundai.

In the 12 months ending 30 September 2023, Chengxin Lithium raked in A$2.27 billion of revenue and A$490 million in net profits after tax (NPAT). Currently, the Shenzhen-listed company is valued at A$3.79 billion.

According to today's release, Pilbara Minerals has executed an amendment to its existing offtake agreement with Chengxin Lithium. The heavily shorted Aussie lithium company will see a material extension and expansion of its original agreement.

The initial 2023 agreement stipulated 70,000 tonnes of spodumene concentrate to be supplied in FY24 from the Pilgangoora operation. However, the newly updated offtake arrangement will see Pilbara Minerals provide spodumene until the end of the 2026 calendar year.

Quantities under the agreement are as follows:

- CY24: Supply an additional 60,000 tonnes for a total of 85,000 of spodumene concentrate

- CY25: Supply 150,000 tonnes of spodumene concentrate

- CY26: Supply 150,000 tonnes of spodumene concentrate

All sales to Chengxin Lithium under the extended offtake agreement will be priced at prevailing market rates.

Will it shake out the Pilbara Minerals share price shorters?

Pilbara Minerals shares have seemingly been in a death spiral since August 2023 — a trend aligning with a slump in lithium prices. As a result, the company's shares have sat atop the most shorted ASX share throne for many weeks.

On Monday, fellow Fool James Mickleboro again disclosed Pilbara Minerals as the most shorted stock on the Australian share market. Roughly one-fifth of shares in the lithium producer were sold short, indicating many are expecting lower prices from here.

However, today's announcement indicates increasing demand for the electrifying commodity from Chengxin Lithium, at least.

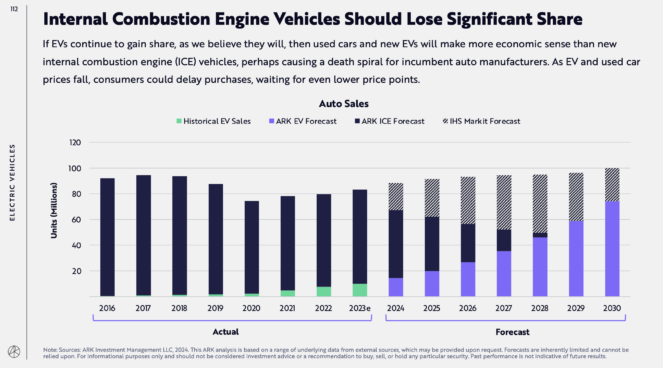

Ultimately, the Pilbara Minerals share price will heavily rely on the underlying commodity's supply and demand. Interestingly, the team at Ark Invest hold a positive view of the future of electric vehicle demand, which could correspond with increasing lithium needs.

As shown above, Ark Invest forecasts approximately a four-fold uptick in EV sales by 2030, surpassing 70 million.

The Pilbara Minerals share price is down 26% over the past year.