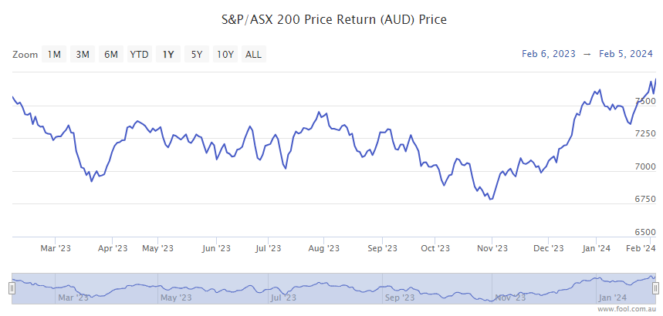

The S&P/ASX 200 Index (ASX: XJO) is well into the red on Monday.

After closing up 1.5% to notch a new all-time high 7,699.4 points on Friday, the benchmark index is down 1.1% in early afternoon trade today.

The ASX 200 is sliding today amid ongoing weakness in China's stock markets. The CSI 300 Index (SHA: 000300) dropped 6.3% in January and closed at a loss again on Friday.

That now sees China's benchmark stock market index down more than 17% over six months and sitting right at five-year lows.

The sell-off in Chinese stocks looks to be driven by ongoing weakness in the nation's critical real estate sector along with broader economic malaise and increasing concerns over potential conflicts with the West.

So, should ASX 200 investors be worried about contagion from the Chinese market spreading Down Under?

Is the ASX 200 vulnerable to the sell-off in Chinese stocks?

The best answer I can give you to that question is no. At least, not yet.

While the ASX 200 and global stock markets are increasingly interconnected, there are reasons to be hopeful that the rout in Chinese stocks may be nearing its conclusion. Barring the unlikely outbreak of any significant conflict with Western powers, that is.

Over the weekend the China Securities Regulatory Commission (CSRC) reported on moves to reduce volatility in the markets. As Bloomberg reports, that includes guiding more medium and long-term funds into the CSI 300.

The CSRC will also target insider trading and "malicious" short selling.

And in good news for other international stock markets like the ASX 200, while Chinese stocks have been tanking, Chinese investors have been investing record amounts into markets outside the middle kingdom.

Bloomberg data showed inflows into Chinese exchange-traded funds (ETFs) tracking foreign benchmarks (excluding Hong Kong) hit US$2 billion (AU$3.1 billion) in January.

Helping drive the S&P 500 Index (INDEXSP: .INX) to a new all-time high, US$1.1 billion of those funds went into US stocks. Japanese stocks were the second biggest beneficiary of the cash outflows with US$204 million.

As for the ASX 200, Australian shares will make up some part of the US$667 million that went into the "other' category.

Commenting on the billions of dollars flowing into international shares via China's onshore ETFs, Peng Hong, fund manager at Shenzhen Zhichang Fund Management, said (quoted by Bloomberg):

Investors are voting with their feet. Chasing these funds at a high premium is risky, but it's choosing the lesser of two evils. US stocks could see a correction taking you to ankle-deep in losses, but if you bottom fish onshore stocks, you are likely to be neck-deep.