Droneshield Ltd (ASX: DRO) shares have flown between small gains and small losses in morning trade today.

Shares in the ASX drone defence tech company closed on Friday trading for 38.5 cents. At time of writing on Monday, shares are swapping hands for 38.2 cents apiece, down 0.8%. In earlier trade shares were up as much as 3.9%.

For some context, the All Ordinaries Index (ASX: XAO) is up 0.4% at this same time.

Here's what investors are mulling over today.

What did the tech company announce?

Droneshield shares are in the spotlight after the company reported (in a non-price sensitive announcement) that it has commenced the release of a "major update" across its global fleet of counterdrone (C-UAS) devices.

All devices that carry Droneshield's artificial intelligence (AI) based drone detection engine, RFAI, will receive the update. Those include portable, vehicle/ship, and fixed site devices.

The company says this will provide "a complete refinement" of the products software and user experience.

Aspects of those upgrades that could impact Droneshield shares in the months ahead include a 25% improvement in emitter detection accuracy and tracking in cases where multiple emitters are present.

The release also noted that the ASX tech company's DroneLocator detections will now provide horizontal distance to detection, vertical distance to detection, true bearing of detection, and relative bearing of detection.

Commenting on the AI updates that could support Droneshield shares longer-term, CEO Oleg Vornik said, "As drones continue to rapidly evolve, there is an ongoing race to detect and respond to those threats."

Vornik added:

Firmware upgrades enable our global community of customers to deal with the latest threats, and we actively collaborate with our end users to receive the latest field intelligence to base our algorithms on.

These updates (together with our computervision AI engine and the sensorfusion engine) grow our SaaS subscriber base and are expected to become a major driver of Droneshield revenue over coming years.

Angus Bean, chief technology officer, said, "Droneshield has grown into a global leader in the C-UAS solutions, driven by our cross-disciplinary engineering teams, listening to our end user community and consistently delivering better performance, usability, and reliability."

How have Droneshield shares been tracking?

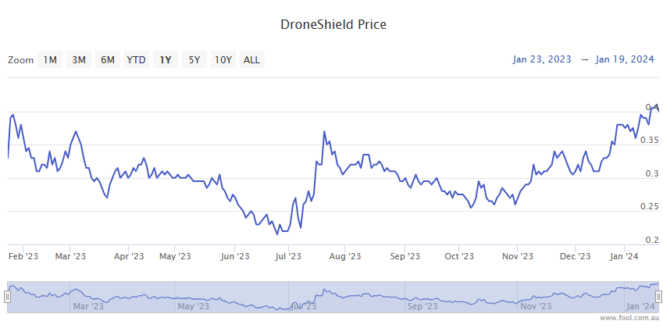

Droneshield shares are up 4% over the past full year.

The ASX tech share has gained 13% over the last six months.