Westpac Banking Corp (ASX: WBC) shares not only offer the potential for capital gains, but the S&P/ASX 200 Index (ASX: XJO) bank stock is also well known for its reliable fully franked dividend payments.

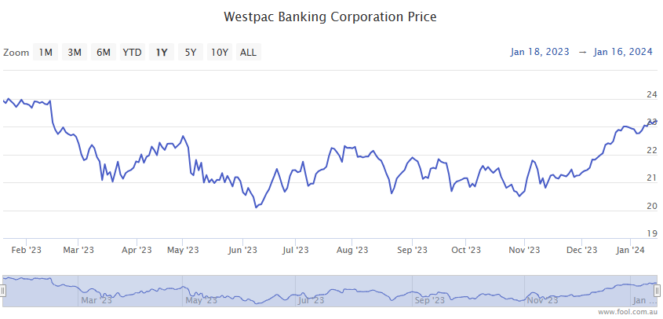

So far in 2023, Westpac shares haven't been able to shake off the broader market pressure. This sees the big four bank's stock down 0.3% year to date, trading for $22.93 apiece.

Though that's a good bit better than the 3.5% loss notched by the ASX 200 so far in 2024.

But that's the market for you. Over the shorter term, there'll always be some down swings along with the up swings.

So, let's take a step back to two years ago to get a better gauge of what this ASX 200 bank stock has delivered for longer-term shareholders.

How much would these Westpac shares have returned by today?

On 28 January 2022, Westpac shares closed the day trading for $20.63 apiece.

That means your $10,000 investment could have bought you 484 shares with enough change left over for a fast-food meal.

Today, as mentioned above, those same shares are worth $22.93.

If you opted to sell your 484 shares today, they'd be worth $11,098. Or a handy $1,098 gain on your $10,000 investment.

But let's not forget those dividends!

If you'd bought $10,000 worth of Westpac stock on 28 January 2022, you'd have received the past four fully franked dividends totalling $2.67 a share. The most recent dividend of 72 cents a share would have landed in your bank account just in time for Christmas, on 19 December.

Adding those dividends back in, the accumulated value of your Westpac shares would now be $25.60 apiece, plus the potential tax benefits from those franking credits.

This brings the total value of your 484 shares to $12,394.

That's a tidy 23.9% gain. Or a profit of $2,394 on your initial $10,000 investment two years ago.