It's looking like another slow day for the All Ordinaries Index (ASX: XAO and most ASX All Ords shares so far this Wednesday. At present, the All Ords has slipped by another 0.18%, leaving the index at just over 7,630 points. But let's talk about the DroneShield Ltd (ASX: DRO) share price.

Droneshield shares are having another top day so far. At the time of writing, the drone detection equipment and software provider has put on a rosy 3.75% and is up to 42 cents a share. Earlier this morning, Droneshield shares climbed as high as 43 cents each.

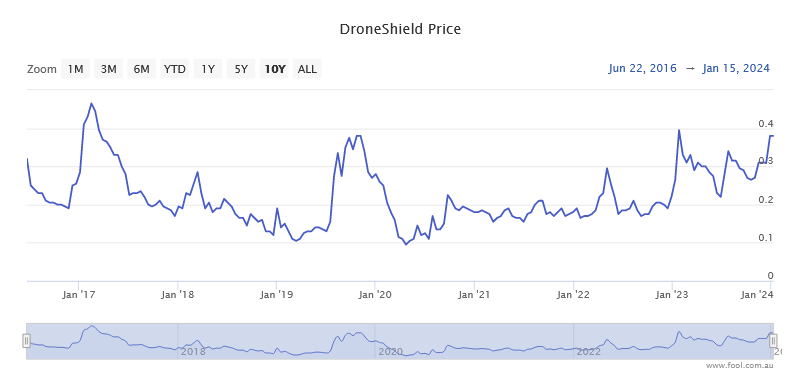

Not only is that figure a new 52-week high for Droneshield, but it's also the highest the company has traded at in seven years. Yep, you'd have to go back to early 2017 to find the last time Droneshield shares were asking 43 cents apiece. See for yourself below:

Today's gains put the Droneshield share price up 8.4% over 2024 so far, as well as up a tidy 52.6% over the past 12 months. So what's going on to elicit these seven-year highs for Droneshield shares today?

Why has the DroneShield share price just hit a 7-year high?

Well, it seems that yesterday's big announcement has something to do with it. Tuesday saw Droneshield release an investor presentation to the markets. As we covered at the time, this saw Droneshield reveal a record $48 million in customer cash receipts and grants for the three months to 31 December 2023.

Over the entire 2023 year, the company was able to haul in $73.5 million, which was five times what it netted over 2022.

This helped Droneshield to deliver its first-ever profit before tax of $4 million. After this presentation was released, Droneshiled shares gained an impressive 8.1% during yesterday's trading.

Today's gains come on top of that. So this is clearly having a big impact on sentiment for the company, and probably explains Droneshield's new multi-year high today.

But things could get even better for investors. Last month, my Fool colleague covered ASX broker Bell Potter's views on the Droneshield share price.

Bell Potter gave the company a buy rating, alongside a 12-month share price target of 50 cents each. If realised, that would see Droneshield shares rise by another 22% or so from today's prices. Here's some of what the broker said:

The company is leveraged to the current trend of global rearmament and the addressable market for counter-drone technology is expected to exceed $7.62 billion USD over the next decade.

No doubt Droneshield investors will be delighted to hear it.