The Vanguard MSCI Index International Shares ETF (ASX: VGS) is a leading exchange-traded fund (ETF) which I regularly say is one of the leading passive investing options on the ASX.

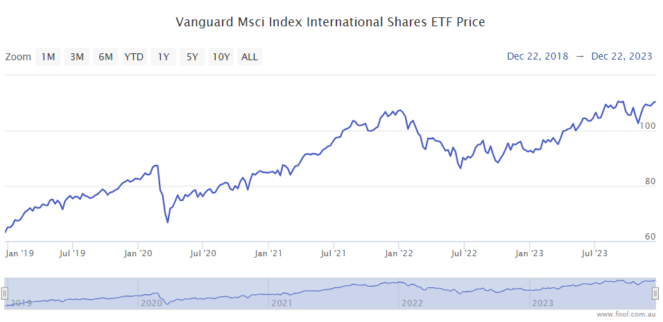

It has been a very good year for the global share market – the VGS ETF has risen by 21% in 2023 to date. This isn't the first strong year and it probably won't be the last.

Reasons to like it

Why is it so good? Because of the strong diversification that it provides and the quality of the holdings in its portfolio.

It owns more than 1,400 businesses from across the world in the portfolio, with an annual management fee of just 0.18%. The lower the fees, the more of the investment returns that stay in the hands of investors.

Some of the world's best businesses are in the portfolio, like Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms, Tesla and Berkshire Hathaway.

There are plenty of non-US companies such as ASML, LVMH, Toyota, SAP, HSBC, Siemens and so on.

Over the five years to November 2023, the VGS ETF has delivered an average return per annum of 12.3%. That's better than the S&P/ASX 200 Index (ASX: XJO) and mostly came from capital growth, though there was a bit of income distributions as well.

Is this a good time to buy?

The VGS ETF is currently sitting close to its 52-week and all-time high, so it's clear to say that this isn't the best price to invest.

There were a number of times during 2022 when the VGS ETF unit price was cheaper than the peak now and the peak of 2021. But, those lower prices are the past – we can't go back in time to take advantage of them now.

We should remember that the underlying businesses in the portfolio are all doing their best to grow profit and increase the underlying value of those stocks. Over time, as a group, these stocks are increasing their underlying value. I think this is why the VGS ETF's lowest point in 2022 was higher than the highest point in 2019.

There have been better times to invest in the past and there may be a lower price in the future, but over the long term, I think this investment can continue to grow in value.

As a bonus, the Aussie dollar has noticeably strengthened in the last three months, meaning Aussies can buy more US dollars/US shares (or assets) than they could before.