The Lynas Rare Earths Ltd (ASX: LYC) share price is leaping higher on Wednesday.

Shares in the S&P/ASX 200 Index (ASX: XJO) rare earths miner closed yesterday trading for $6.75 apiece. In afternoon trade today, shares are swapping hands for $6.89, up 2.1%.

For some context, the ASX 200 is up 0.6% at this same time.

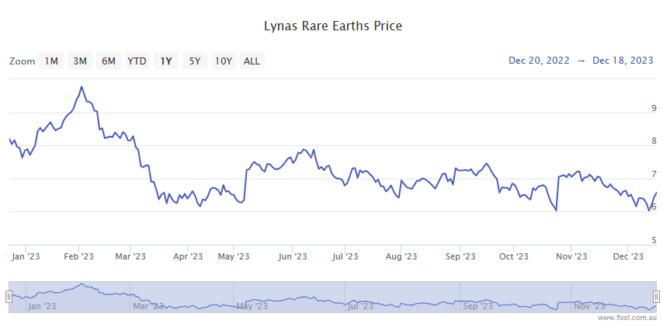

That still leaves the Lynas share price down 10% year to date.

But according to leading broker Bell Potter, 2024 could see the ASX 200 miner recoup those losses…and a good bit more.

Lynas share price forecast to surge

According to Bell Potter's resources analysts, Stuart Howe and Regan Burrows, "Decarbonising technologies (EVs, renewables, storage) will remain as key drivers of strategic minerals demand."

They add that, "ESG and supply chain security remain overarching themes, favouring Australian and Canadian based critical minerals projects."

And as an Australian based rare earths mining and processing business, the Lynas share price could catch some heady tailwinds in 2024.

According to Bell Potter:

At the beginning of year rare earth prices, particularly Neodymium (Nd) and Praseodymium (Pr), weakened as the sector worked through increased supply from China and slower than anticipated electric vehicle demand. We have since seen a normalisation in pricing back towards US$70/kg.

Bell Potter's analysts note that Lynas is "the highest quality source of ex-China rare earth supply".

And they point out that the ASX 200 rare earths miner has "a trajectory towards doubling capacity over the next three years via the expansion of their mining and concentrating capacity at Mt Weld".

In late October the Lynas share price enjoyed a big boost when the miner received a variation to its operating licence from the Malaysian government to continue importing and processing lanthanide concentrate. Importations of the concentrate, sourced from its Mt Weld mine in Western Australia, had faced the axe under an earlier operating licence extension received in February.

The amended operating licence received in October runs through 2 March 2026.

Bell Potter has a 'buy' rating on the ASX 200 rare earths miner, with a price target of $8.80 a share.

That represents a potential upside of 27.7% from the current Lynas share price.