In this article, I'm going to show you how investing $1,200 per year can turn into more than $1 million — if we're patient — by using ASX-listed exchange-traded funds (ETFs).

The great thing about investing is that some options can deliver outperformance, and we don't need to do a ton of analysis to achieve it.

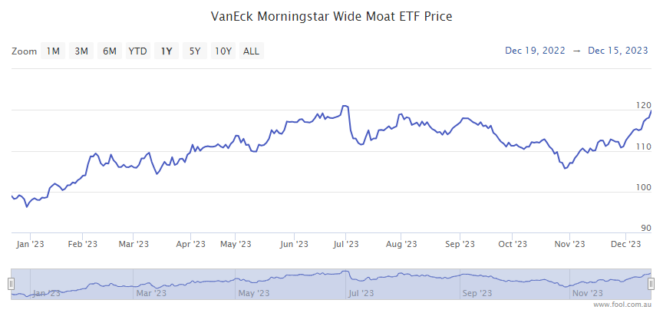

I know which ETF I'd utilise to help build my wealth. I believe in the long-term compounding potential of Vaneck Morningstar Wide Moat ETF (ASX: MOAT), and I'm going to tell you how it could help make you a millionaire.

But remember, no return is guaranteed, and past performance isn't necessarily useful for helping us figure out what the return of the share market is going to be in the next few years.

Over the ultra-long term, the share market has delivered an average annual return of around 10%. I think the MOAT ETF can do better than that, not because it has, but because its investment style creates a portfolio that can outperform.

MOAT ETF investment style

VanEck says this ASX ETF gives investors exposure to a diversified portfolio of attractively priced US companies with sustainable competitive advantages, according to Morningstar's equity research team.

There are three things worth exploring a little more from that description.

First, the diversified nature of it. It will always own at least 40 stocks in the portfolio — right now, there are 50. It doesn't have a specific sector allocation, but its holdings are from a variety of sectors.

At the end of November, the weighting was: financials (20.4%), healthcare (18.9%), IT (15.9%), industrials (15.7%), consumer discretionary (8.7%), communication services (7.8%), materials (7.3%) and consumer staples (5.2%).

Second, the target companies are trading at "attractive prices relative to Morningstar's estimate of fair value". Ideally, the portfolio is full of good value businesses.

Finally, and most importantly, the portfolio is aimed at quality US companies that Morningstar believes possess sustainable competitive advantages or wide economic moats.

For a company to earn 'wide economic moat' status, Morningstar thinks that excess normalised returns must, "with near certainty", be positive 10 years from now. In addition, excess normalised returns must, more likely than not, be positive 20 years from now.

For Morningstar, the duration of forecast economic profits is "far more important than the absolute magnitude".

There are a few sources of moats – cost advantage, intangible assets (eg patents, brands or regulatory licenses), switching costs, network effects and efficient scale.

Great businesses at good prices are a very powerful investment combination.

At the end of November 2023, the prior three years showed an average return per annum of 14.2% and a 15.05% return per annum since inception in June 2015.

Multimillionaire potential

Investing $1,200 per year in this ASX ETF doesn't sound like that much — it's only $100 per month!

It's really difficult to say what the MOAT ETF return will be from here. But, just for the fun of it, let's say the net return continues to be an average of 15% per annum.

Investing $1,200 per year, and if the MOAT ETF returned 15% per annum, would reach almost $2.1 million in 40 years. A 25-year-old could reach that by 65.

If someone invested $2,400 per year, it could get to $2.03 million in 35 years.

Investing $12,000 per year could get to $2.2 million in 24 years.

Keep in mind the MOAT ETF could do worse, or better, than 15% per annum from here. Either way, this is one ASX ETF that I'm very excited by.