Woodside Energy Group Ltd (ASX: WDS) shares are in the red today.

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock closed yesterday trading for $30.26. In morning trade on Tuesday, shares are changing hands for $30.12 apiece, down 0.5%.

For some context, the ASX 200 is up 0.1% at this same time.

That's today's price action for you.

Now here's what investors in Woodside shares will want to know out of Dubai, where the 28th United Nations Climate Change Conference, or Cop28, is still underway.

ASX 200 energy shares find support in Dubai

Woodside shares, as you're likely aware, derive their revenue from gas and oil.

Gas has been touted as a cleaner fuel and one that's potentially critical for the world's energy transition. But that hasn't kept gas from joining oil and coal on the cutting floor at Cop28.

Previous language in a climate deal intended to cut global emissions and reach the vaunted net zero by 2050 had called for the "phase out" of coal, oil and gas.

But members from the Organization of the Petroleum Exporting Countries (OPEC), spearheaded by Saudi Arabia, have long pushed back against this kind of strict language and measures.

Instead, the new draft proposal at Cop28 now calls for "reducing" the use of fuels like oil and gas.

Part of the new draft promotes "reducing both consumption and production of fossil fuels, in a just, orderly and equitable manner so as to achieve net zero by, before, or around 2050".

While that watered-down language may be good news for the longer-term outlook for Woodside shares, not everyone was pleased with the changes.

Bill Hare, CEO of Climate Analytics said (quoted by The Australian Financial Review), "Everything is optional. Any mention of deadlines has been watered down, along with the removal of the words 'phase out'."

Hare added, "Every single thing you could think of that the fossil fuel industry would want is in there."

How have Woodside shares been tracking longer-term?

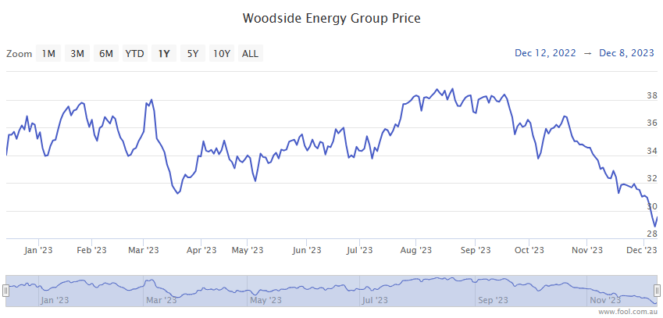

Woodside shares are down 14% over the past year, pressured by sliding oil and gas prices.

Investors who bought shares two years ago will still be sitting on gains of 37%.