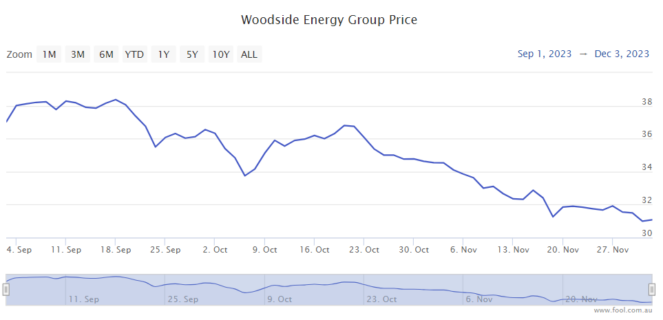

The Woodside Energy Group Ltd (ASX: WDS) share price has been struggling in recent times. It fell 9% in November 2023 and is down around 20% since mid-September 2023. What's happening to the ASX energy share?

As a resource company, the price of its commodity is key for profitability. If the price rises, extra revenue largely turns into net profit after tax (NPAT). But the opposite usually happens when commodity prices fall. This can be a negative for the Woodside share price.

What's happening to energy prices?

The oil price was close to US$100 per barrel in September. Since then, it has steadily declined to less than US$80 per barrel.

There are signs that the global economy is weakening in some parts, with "sluggish global manufacturing activity", according to reporting by Reuters. Manufacturing is suffering from "soft" demand, with Eurozone factory activity shrinking and "mixed signs" on the Chinese economy.

At the end of November, OPEC+ countries agreed to remove around 2.2 million barrels of oil per day in the first quarter of next year. OPEC+ includes Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia, the United Arab Emirates and Venezuela.

But, the agreed cuts are voluntary, so there are questions about whether producers will implement them and how the cuts will be measured. Reuters quoted OANDA analyst Craig Erlam, who said:

(It) seems traders either aren't buying that members will be compliant or don't view it as being sufficient.

LNG prices have been dropping too. The Asian spot LNG price recently hit a 7-week low, with weak demand despite the colder weather, though supply was increasing. That's tough news for Woodside shares because a lot of its business is focused on LNG.

Reuters quoted Toby Copson, head of energy, APAC, Marex, who said:

Rates in Asia and notably Europe continue to slide. Demand has remained weak across all players.

It's clear weather and industrial demand hasn't brought any urgent covering going into winter which doesn't set a good precedent for a bullish outlook.

What could happen to the Woodside share price next?

Predicting a share price movement is tricky, particularly when it comes to an ASX energy share that depends on volatile energy prices.

The broker UBS is cautious of growing risks with the Scarborough and Pluto 2 schedule, and pressure on regulatory approvals could "stifle further equity sell-downs/LNG sales from Scarborough".

UBS recently cut its projection of earnings for Woodside between now and 2025 because of the lower LNG price environment.

The broker has a price target of A$35.40 on Woodside shares, which implies a possible rise of around 15% in the next year. But, that would only get the ASX energy share back to where it was in October 2023.