Something rather bizarre has happened to a popular ASX 200 energy stock during the early hours of this Wednesday's trading session. The energy stock in question closed at $2.40 a share yesterday, and opened at $2.41 this morning before rising up to $2.45.

But soon after, the shares promptly plummeted, falling to a low of $2.10 each after just half an hour of market trading. That's a fall worth 10.42% based on yesterday's close, and more than 12% from that $2.45 peak.

The ASX 200 energy stock we're talking about is none other than Karoon Energy Ltd (ASX: KAR).

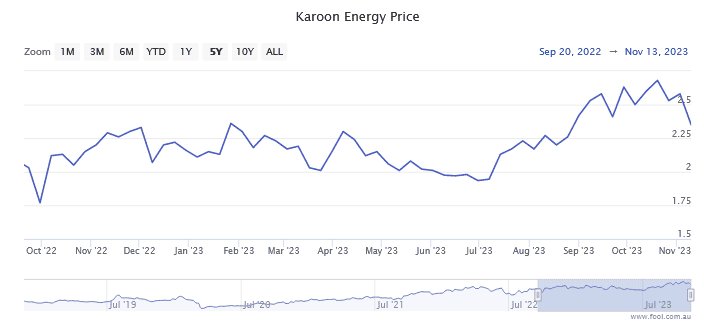

Karoon is an energy stock that has only been a member of the S&P/ASX 200 Index (ASX: XJO) since September 2022. Since that time, it has had a relatively successful stint as an ASX 200 stock, as you can see below:

That brings us back to today's strange share price moves.

At around 10:30am (AEDT), following this 10% share price plunge, Karoon shares were promptly suspended from trading. The company said little in its announcement, only that "trading in the securities of the entity will be temporarily paused pending a further announcement".

Half an hour later, the ASX 200 energy stock released another announcement, which slightly elaborated. Here's some of what it said:

Karoon Energy Ltd… requests that the securities of Karoon are placed in a trading halt with immediate effect….

The trading halt is requested pending an announcement by Karoon in relation to a potential transaction… Karoon requests that the trading halt remain in place until the commencement of trading on Friday, 17 November 2023.

And… that's all we know for sure as of the time of writing.

ASX 200 energy stock Karoon halted amid potential capital raise

Reporting in the Australian Financial Review (AFR) today has picked up a potential catalyst for this trading halt though. According to the report:

Brazilian oil and gas play Karoon Energy is raising $US300 million ($460 million) via Macquarie Capital. Proceeds will be used to purchase operating assets in the US…

If this indeed does turn out to be the case here, it seems that at least some investors are wary of what Karoon has to say. Something obviously got out early today, judging by the sudden crash in this ASX 200 energy stock's share price.

Karoon only has a market capitalisation of $1.35 billion, so if the company is indeed raising $460 million, it would represent a massive chunk of change for the ASX 200 energy stock. That's all we know for now, but watch this space.