It's been a rather dreary start to the trading week for the Fortescue Metals Group Limited (ASX: FMG) share price this Monday. At the time of writing, Fortescue shares have slipped by 0.3% and are down to $23.16 each.

But Fortescue investors arguably don't have too much to complain about. That's because this ASX 200 iron ore mining giant is still up more than 11% over just the past fortnight alone.

Yep, two weeks ago today, Fortescue closed at $20.81 a share. That means investors have enjoyed a rise of 11.2% over just the past fortnight, which is more than the historic annual average return of the S&P/ASX 200 Index (ASX: XJO).

Investors seem to have flooded into the miner's stock on the back of rising iron ore prices and hopes for strong future demand.

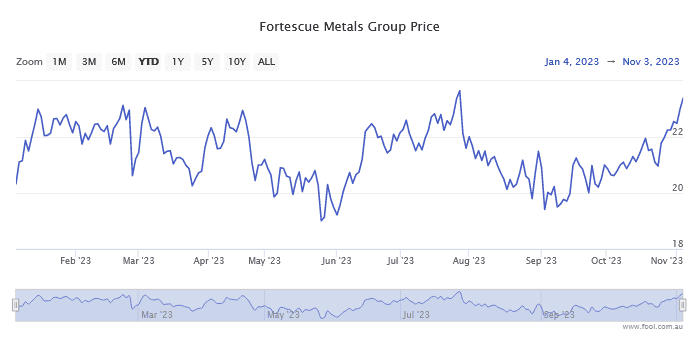

This meteoric gain since 23 October puts the Fortescue share price up a robust 13.3% over 2023 to date, as well as up almost 20% since early September. Check that out for yourself below:

But given these sharp and dramatic share price moves in recent weeks, many investors might be wondering what's next for the Fortescue share price. After all, iron ore miners tend to be some of the most volatile ASX 200 blue chips.

Well, let's check out what one ASX expert is saying about Fortescue's future.

What's next for the Fortescue Metals share price?

Peter Day of Sequoia Wealth Management, recently spoke to The Bull about his views on a few ASX shares, including Fortescue. And it may make for some uncomfortable reading for any Fortescue stakeholders out there.

Labelling Fortescue shares as a 'sell' right now, Day did like Fortescue's most recent quarterly production numbers, but thinks the shares might have run ahead of themselves. Here's what he said in full:

Iron ore production in the first quarter of fiscal year 2024 was stronger than expected, in our view, while sales, realised prices and costs met expectations. Full year 2024 volumes, costs and capital expenditure guidance remains unchanged.

However, we note that Iron Bridge shipments were downgraded to 5 million tonnes at the recent site tour. The shares have risen from $20.81 on October 23 to close at $23.25 on November 2. Investors may want to consider cashing in some gains.

Day isn't the only expert currently not impressed with Fortescue's future prospects either.

As we covered last month, ASX broker Goldman Sachs has also taken a negative view of the miner. It too has a 'sell' rating on Fortescue shares on valuation grounds, alongside a 12-month share price target of $16.20.

So not a lot of good news coming out of ASX experts right now for Fortescue investors. But let's see what happens next. At the current Fortescue share price, this ASX 200 iron ore share has a market capitalisation of $71.4 billion, with a trailing dividend yield of 7.55%.