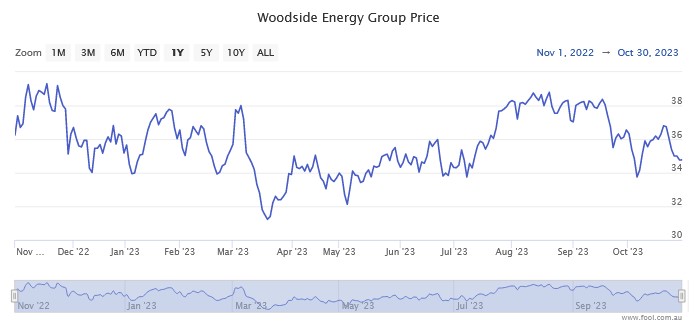

The Woodside Energy Group Ltd (ASX: WDS) share price has been on a bit of a wild ride over the past month or so. Thanks largely to whipsawing energy prices on the back of the terrible conflict in the Middle East, Woodside shares have been on a bit of a rollercoaster.

Between 6 and 18 October, this ASX 200 energy stock rocketed more than 7%, only to fall by around 6.3% between 18 October and today. This Wednesday has seen the oil producer gain a healthy 0.9%, leaving Woodside shares at $34.56 each at present.

That's despite big falls in both the West Texas Intermediate (WTI) and Brent crude oil prices overnight, as we covered this morning.

Today's gains still leave the Woodside share price with a year-to-date loss of 2.2%. Check all of that out for yourself below:

So with this volatile performance from Woodside shares over 2023 to date, many investors and shareholders might be wondering whether this oil stock is on track for a strong finish to the year, or whether Woodside might enter 2024 with a whimper.

What's next for Woodside Energy shares?

Well, one ASX expert reckons it's a clear case for the former proposition. Atlas Funds Management's chief investment officer Hugh Dive has just released an October trading update for investors to digest as we head into the second-last month of the year.

In this update, Dive reflects on the Woodside share price, and where it might be heading next. Here's what he had to say:

Woodside Energy had a solid quarter, with production up +8% to 48 million barrels of oil. The company also announced that they had started producing at a new field in the Gulf of Mexico which was six months ahead of expectations, which saw full year guidance being upgraded.

Woodside has little exposure to a weakening Australian consumer, selling energy into a global market primarily via long-term off-take agreements to utilities in Japan, China and Korea. Stronger energy prices in the latter part of 2023 and a weaker Australian dollar are setting Woodside up for a strong finish to the year.

No doubt Woodside investors will be delighted with that assessment. But we'll have to wait and see what happens, particularly noting the ongoing uncertainty in the global oil price's future given the current geopolitical situation.

At the present Woodside share price, this ASX 200 energy share has a market capitalisation of $65.58 billion, with a trailing dividend yield of 9.84%.