The Vanguard Australian Government Bond Index ETF (ASX: VGB) is a $1 billion fund that could be an attractive one to consider in the current era.

As the name suggests, it's an exchange-traded fund (ETF) that focuses on bonds from Australian government entities.

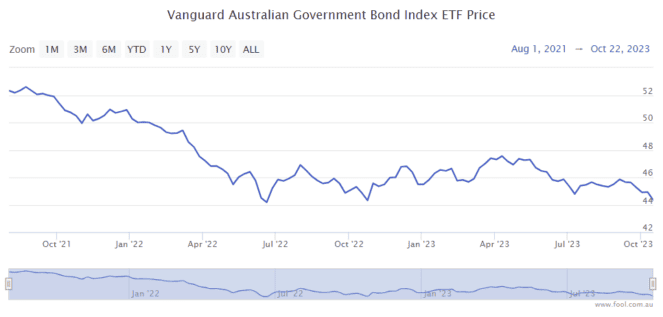

When interest rates were rising, the price of a lot of bonds went down in 2022 because the bond rate wasn't as attractive as what investors could now get. Just look at the chart below for what happened to the VGB ETF unit price. It has fallen by 15% since August 2021. This is a big decline for an asset class meant to offer safety compared to (ASX) shares.

What bonds does the VGB ETF invest in?

The Vanguard Australian Government Bond Index ETF invests in nine different issuers. In order, these are:

- Commonwealth of Australia (Federal Government)

- State of Victoria

- State of New South Wales

- State of Queensland

- State of Western Australia

- State of South Australia

- Government of the Australian Capital Territory

- Government of Northern Territory

- State of Tasmania

So, it lives up to its name of being a fund that invests in Australian government bonds.

According to Vanguard, 77.6% of the fund invests in AAA-rated bonds and 22.4% is invested in AA-rated bonds.

How much passive income does it offer?

Vanguard discloses a number of financial statistics about the bond portfolio.

One of the key statistics is the yield to maturity. This is the rate of return an investor would receive if the fund's fixed-income securities were held to their maturity dates.

According to Vanguard, the yield to maturity of the VGB ETF was 4.4% at the end of September 2023. That's a decent yield, considering where interest rates were a couple of years ago.

If the RBA lifts interest rates again, then I'd expect investors may be able to get a better yield from the VGB ETF. If rates go down, I'd expect that the yield will go down and that the unit price of the ETF will go up.

Does the VGB ETF deserve to be in a portfolio?

Interest rates appear to be (fairly) close to the top, so I don't think there is going to be much downside left for the unit price. It's probably premature to think that interest rates are going to fall, so I'm not expecting much of a capital gain in the medium term either.

With yields now much higher, Australian bonds could have a place in a portfolio, particularly for retirees who want a decent yield and less volatility than shares.

It's not something that I'm looking to invest in because I want to find assets that could deliver more growth over the long term.