The Propel Funeral Partners Ltd (ASX: PFP) share price is up 3.17% at $4.55 as the market learned today of potential takeover interest.

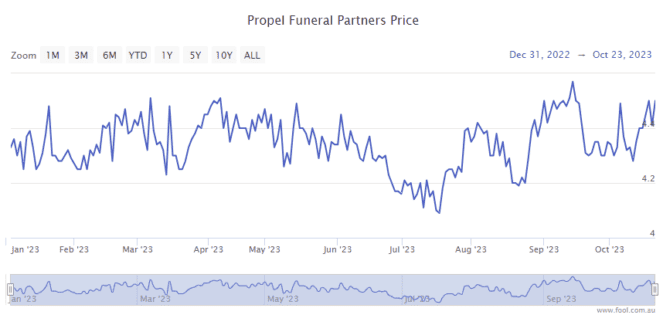

October has been a positive month for the company so far, as we can see on the chart below. The Propel share price has gained around 6% in the month to date.

Takeover talk

In today's announcement, the funeral operator referred to media speculation about possible activity surrounding the company.

It confirmed it had received "inbound interest" regarding a potential change of control transaction from multiple parties. In other words, there are a number of groups looking at potentially acquiring Propel Funeral Partners.

However, the company advised that the nature of these offers was "unsolicited, preliminary, highly conditional and non-binding". So, nothing to get too excited about for the Propel Funeral share price just yet.

The Propel board of directors assured investors it was committed to acting in the best interests of the company and its shareholders to ensure that a transaction (if any) occurred on a basis that was "compelling".

Has an agreement been made?

The ASX share's board has decided that the interest to date has not been compelling and therefore, has not engaged with any party about this interest. Propel advised that no action was required by shareholders at this time.

As the company noted, there may not be any transaction as a result of this communication.

It has appointed Barrenjoey as the financial adviser and Corrs Chambers Westgarth as legal adviser. Propel noted it would continue to update the market as any developments occur.

Recent Propel Funeral share price performance

Since the start of 2023, shares in the funeral operator have lifted 4%. That compares to a 1.5% fall in the S&P/ASX 200 Index (ASX: XJO).

In FY23, Propel generated revenue of $168.5 million (up 16%), while operating net profit after tax (NPAT) increased 17.9% to $20.9 million. It also grew its annual dividend per share by 14.2% to 14 cents.

In FY24, the company expects revenue to grow to between $200 million and $220 million. Operating earnings before interest, tax, depreciation and amortisation (EBITDA) is expected to grow between $54 million to $60 million, up from $46 million in FY23.