DroneShield Ltd (ASX: DRO) shares are zipping higher on Tuesday, doubling down on yesterday's sensational performance.

Today, the DroneShield share price is tracking 0.79% higher, hitting 32 cents per share. Shares in the drone defence company have gained 60% over the past year, boosted by contract wins among other positive developments.

The impressive 12-month performance is comparable to how other technology stocks fared on the ASX. Rebounding from a treacherous 2022, the Aussie information technology sector is now the best-performing segment of the market over one year.

Are the good times expected to keep on rolling for this ASX small-cap? Or is this drone now flying too high?

Is this just the beginning for DroneShield shares?

Yesterday, DroneShield announced it had received a $33 million order from a United States government agency. Marking a new record contract value, investors responded by bidding up the DroneShield share price by 18.9%.

Notably, management expects full payment to be received before the end of the calendar year. If so, the company could see its FY23 revenue nearly double from the prior year ($16.9 million) on the receipt of this contract alone.

After digesting the milestone news, Bell Potter has shared its perspective on DroneShield today. According to the broker, it considers the contract a 'game changer' for the drone defence company. In turn, it has lifted its DroneShield share price target to 45 cents, accompanied by a buy rating.

Bell Potter pointed out that DroneShield's current backlog is at a record $62 million. This is reassuring for shareholders. Defence contracts can be lumpy work, leading some companies to come unstuck if their backlog runs dry.

What else to consider?

For the 12 months ending 31 December 2022, DroneShield reported figures placing it the closest to positive free cash flow that it has been in seven years. The increased scale of operations and contract value could position the company for self-sufficiency.

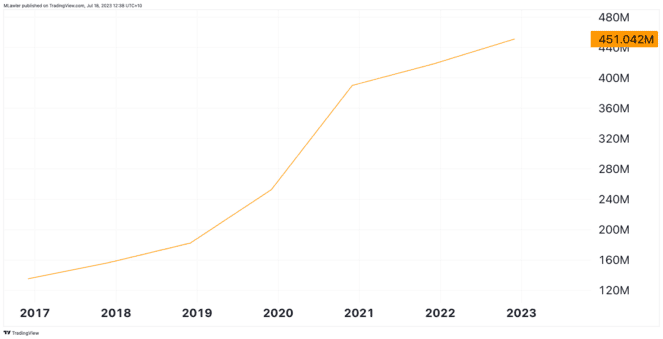

Since 2017, total shares outstanding have more than tripled, as shown below, as the company has undertaken dilutive capital raises to fund its growth. However, the recent traction and increased order size might instil confidence in investors that those dilutive days are ending.

Interestingly, both CEO Oleg Vornick and chair Peter James sold down their DroneShield shares in July. The pair still retain 0.86% and 0.65% stakes in the ASX-listed small cap at the time of writing.