The Altium Limited (ASX: ALU) share price will be one to watch on Tuesday morning following the release of the printed circuit board (PCB) design software provider's full year results after the market close.

For the 12 months ended June 30, Altium posted full year revenue of US$171.8 million and an EBITDA margin of 36.5%. This was a 22.6% increase on the prior corresponding period and means the company is within a whisker of its FY 2020 target of US$200 million revenue.

This led to Altium posting a 39.8% increase in EBITDA to US$62.7 million and a 41.1% lift in net profit after tax to US$52.9 million. Earnings per share came in 40.5% higher at 40.6 U.S. cents (59.9 Australian cents) and the Altium board declared a full year dividend of 34 cents per share.

What were the drivers of the result?

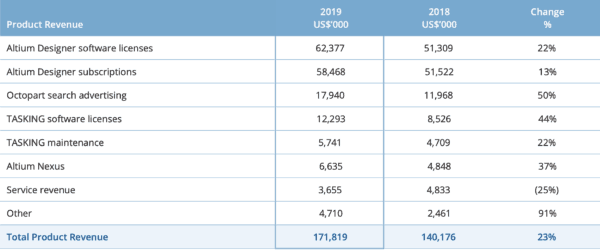

The key driver of growth once again was its Altium Designer product which recorded a 22% lift in software license revenue to US$62.4 million and a 13% increase in subscriptions revenue to US$58.5 million. The catalyst for this was a 27% jump in Altium Designer seats and record growth in its subscription base to more than 43,600 subscribers.

This was supported by the Octopart business which recorded a 50% increase in search advertising revenue to US$17.9 million and its TASKING software licence revenue which grew 44% to US$12.3 million.

A breakdown on its performance is shown below:

Altium's CFO, Joe Bedewi, revealed that the Chinese market was a key driver of growth during the financial year.

Mr Bedewi said: "China built further momentum over the fiscal year with 37% revenue growth, which is an endorsement that our investment in additional China based resources has paid off and will allow us to scale up our operations and revenues in the region. The US and EMEA both performed well delivering 14% and 20% revenue growth respectively, as we implement our next generation transactional sales that leverages further systematization and greater account-based intelligence."

The company's CEO, Aram Mirkazemi, was rightfully pleased with the company's performance in FY 2019 and appears confident in the future.

He said: "What makes this performance most outstanding is that it has been achieved while Altium has been focused intensely on investing to accelerate future growth. We are increasing the efficiency and reach of our transactional sales model and rolling out our new cloud platform Altium 365. These initiatives will power Altium's drive to market dominance and the achievement of our 2025 targets of 100,000 subscribers and US$500 million in revenue."

Outlook.

Altium advised that it is "confident of achieving its 2020 target of US$200 million revenue and commits to a higher EBITDA margin floor of 37% (excluding the impact of the new leasing standard)."

It also anticipates reaching 50,000 of its 100,000 subscribers target as early as 2020. This will put it half way to achieving market dominance.