Lynas Corporation Ltd (ASX: LYC) is a rare earths minerals producer. Rare earths are a group of 17 metals that have emerged as a backbone material responsible for the production of everyday products such as computer memory, rechargeable batteries, cell phones and much more.

China is threatening to restrict the supply of rare earth minerals to the United States (US), in the heat of the US–China trade war. To add some context, China controls some 80% of the world's rare earth production. The US imports some $160 billion of these materials from China. These minerals play a vital role in maintaining key defence and aerospace technologies such as satellite communications, motors and lasers.

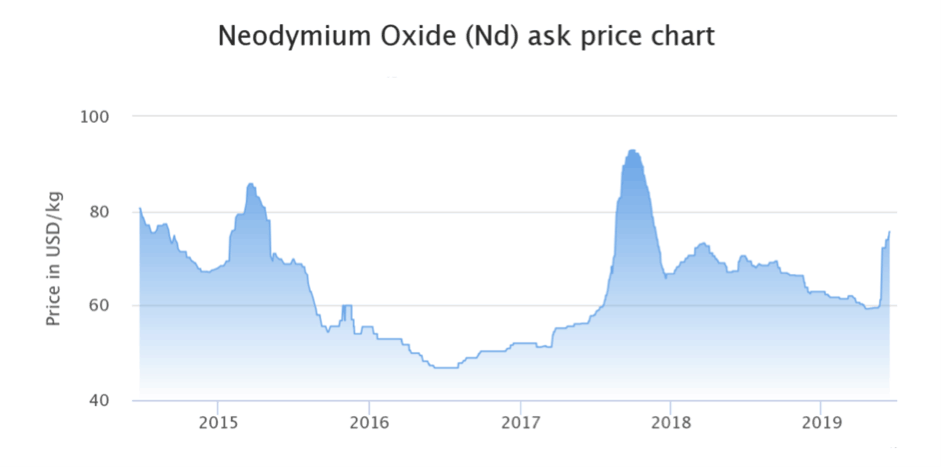

The uncertainty surrounding the supply of rare earth materials has caused a significant spike in the price of the portfolio of minerals. For example, Neodymium Oxide, one of Lynas's main rare earth outputs, had its spot price soar from US$60/kg to $75. This price rise could just be the beginning if China proceeds with its trade embargo.

Lynas is uniquely positioned as one of the only major producers of rare earths outside China. The company's flagship mine, Mount Weld is one of the highest-grade rare-earth deposits in the world.

Lynas is already on the move, having recently signed an MOU with Blue Corporation, a Texas-based corporation, to develop rare earths separation capacity in the US. The aim of this joint venture is to fill a key gap in the US supply chain and ensure that US companies have continued access to rare earth products.

Is it a buy?

I believe Lynas could be a buy within the coming days or weeks depending on what course of action China decides to take. The Lynas share price has already lifted some 50% in the past month and is therefore a bit extended for my liking.

With that being said, the Lynas story has greatly improved, independent of US–China drama.

In the company's quarterly report for the period ending 31 March it reported a solid $103.3 million in sales revenue, up 26.8% on the prior quarter and a new record quarterly production of 1,591 tonnes NdPr produced.

More recently, Lynas acknowledged the Malaysian Prime Minister's comments about the importance of the continuation of the Lynas operations in Kuantan, Malaysia. This follows months of domestic and governmental scrutiny from the environmental damage and waste from the company's advanced materials plant in Malaysia.

Foolish takeaway

The Lynas story keeps getting better and better now that the Malaysian concerns have subsided, preliminary partnerships in America have been established, and the potential for the US-China threat to send rare earth prices flying. Investors should watch closely for any opportunities to add Lynas to their growth portfolios.

For another high-growth stock to add to your portfolio, take a look at this unique, little-known ASX company set to profit off the coming marijuana boom.