The Fairfax media is this afternoon reporting that the ASX's hottest stock right now in AfterPay Touch Group Ltd (ASX: APT) is refusing to disclose the share structure of its US subsidiary AfterPay Inc. However, Fairfax also concedes in its article that AfterPay must legally own at least 90% of AfterPay Inc. to suggest the ownership structure of it is not of material importance to investors.

Fairfax and AfterPay's ASX release of April 15 also note that AfterPay can issue up to 21.77 million in new shares to its US investors (principally Matrix Capital) and employees with the deal seemingly structured so that more shares are awarded to the US investors if the US business outperforms the UK and Australian businesses.

This from AfterPay's release: "APT considers it unlikely that the maximum number of APT shares would be issued because for this to happen it would necessarily mean that the value of APT (excluding the US business) is negligible or very low in comparison to the assessed value of Afterpay US Inc."

In response to the news AfterPay shares are down 2% to $24.30 this morning but the issue of new shares to employees or investors should not be a surprise to anyone who took a look at its accounts for the half year ending December 31 2019.

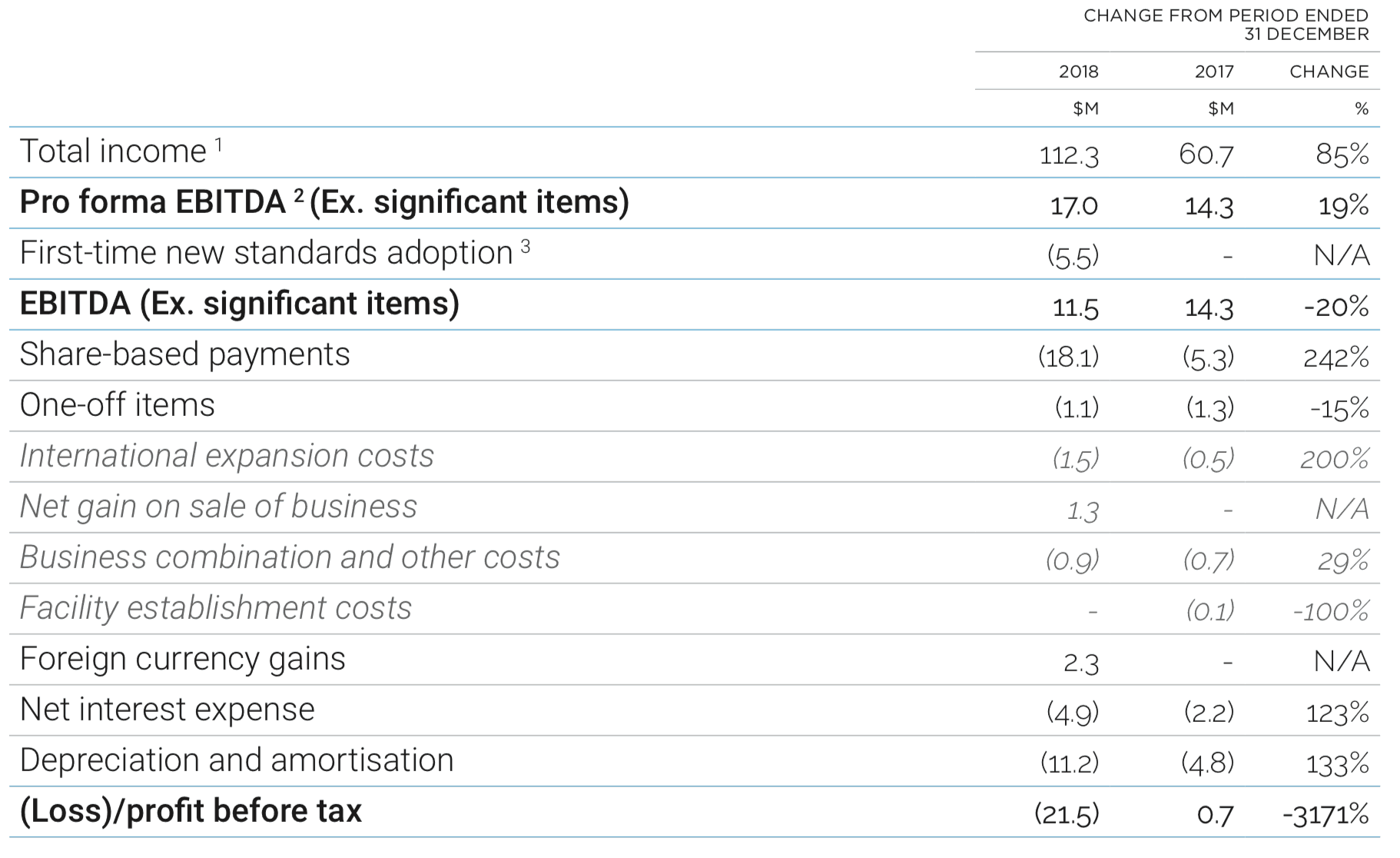

Source: AfterPay half-year report ending December 31 2019.

Source: AfterPay half-year report ending December 31 2019.

We can see that share-based payments to employees of $18.1 million ballooned from $5.3 million in the pcp and now take the biggest chunk out of income to drag the group into its net loss position of $21.5 million.

Again it's no secret AfterPay is attempting to ramp up its potentially game-changing push into the U.S. and you cannot do that without a boat load of quality staff. In fact I've commented previously that perhaps the most impressive thing about AfterPay's vertiginous rise is its ability to find the right staff to expand so quickly.

The issuing of share-based payments is also standard practice for just about every fast-growing tech business in the U.S. and if you look through the accounts of any listed U.S. tech business you will see share-based payments or the issue of options are always one of the larger costs.

Therefore you can take a glass half full or half empty approach to this issue, in that the payments hurt the bottom line, but are the sign of a successful company that needs to incentivise staff properly if it wants to retain the top talented needed.

As such I wouldn't be worried about the issue or the Fairfax report, although the revelation that AfterPay Australia may not own up to 10% of AfterPay US has caught me by surprise.

I'd still rate AfterPay a hold for now as investors may get a cheaper price to buy in before the end of 2019.