The Western Areas Ltd (ASX: WSA) share price is down 4.5% to $2.25 today and has tracked volatility in the nickel price all week as geopolitical uncertainty unnerves investors.

For the six-months ending December 31 2018 Western Areas posted a net profit of $200,000 on revenue of $123.7 million, at an average realised nickel price (before payability) of A$7.45/lb, compared to A$6.81/lb in the prior corresponding half.

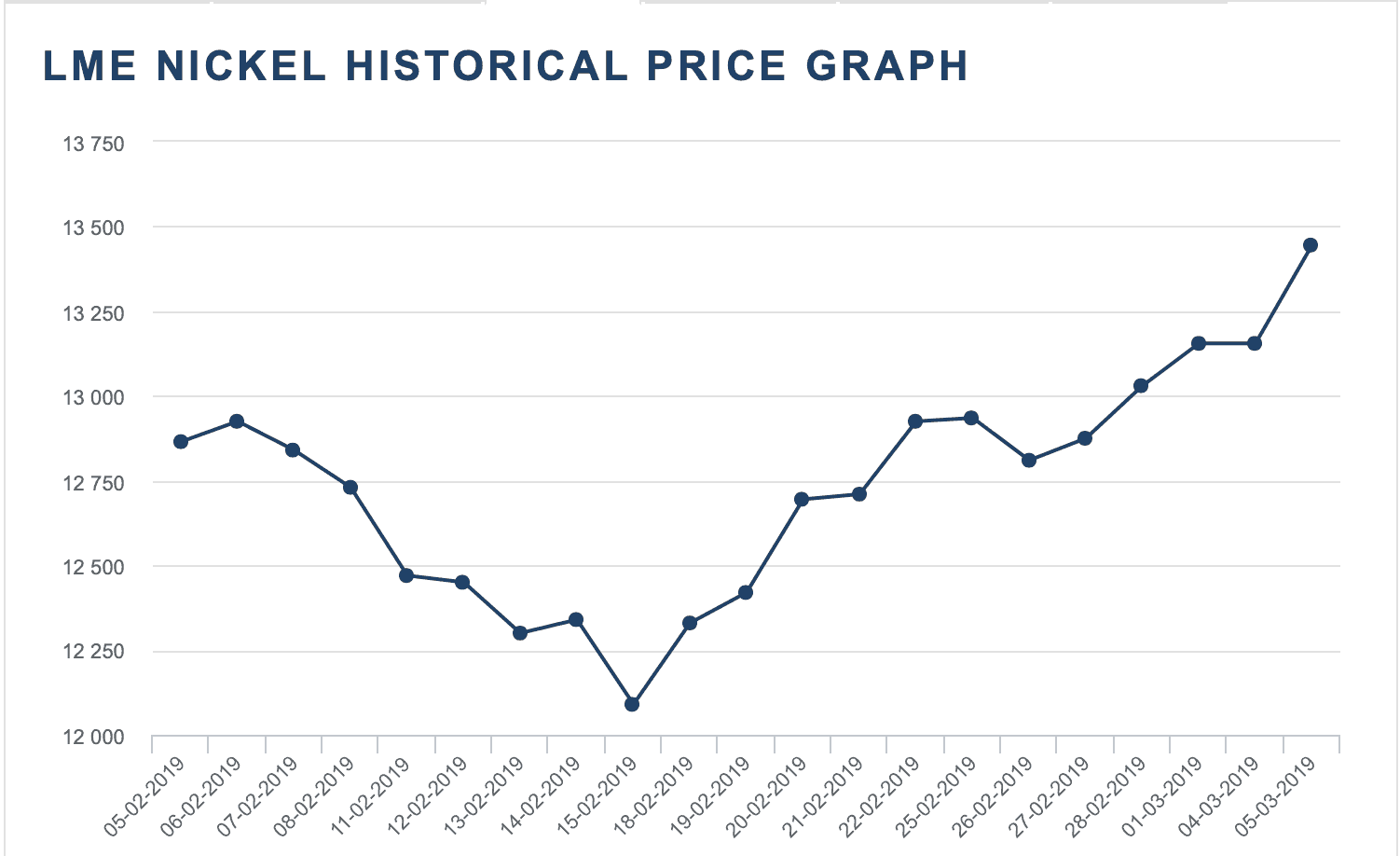

As we can see from the chart below the nickel price has gradually tracked higher over the past month with plenty of volatility like the Western Areas share price.

Source: London Metals Exchange, copper price per tonne in USD

Western Areas has a strong balance sheet with $134 million cash on hand and no debt, as such its stock is likely to follow nickel prices higher if this scenario comes about.

Nickel bulls point to rising demand from electric vehicle and battery makers, while bears suggest over supply might flood the market.